Growing E-commerce and Retail Sector

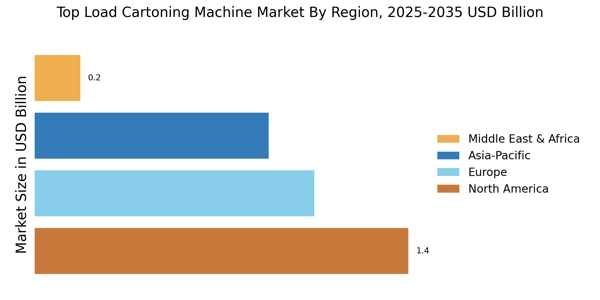

The Top Load Cartoning Machine Market is benefiting from the rapid growth of the e-commerce and retail sector. As online shopping continues to gain traction, the demand for efficient and reliable packaging solutions is escalating. Top load cartoning machines are particularly well-suited for e-commerce applications, as they facilitate quick and secure packaging of products for shipment. Recent statistics indicate that e-commerce sales are expected to surpass 4 trillion dollars by 2025, driving the need for effective packaging solutions. This trend is likely to bolster the demand for top load cartoning machines, as retailers and e-commerce companies seek to enhance their packaging processes.

Sustainability Initiatives in Packaging

The Top Load Cartoning Machine Market is increasingly influenced by sustainability initiatives in packaging. As environmental concerns rise, manufacturers are seeking eco-friendly packaging solutions that minimize waste and reduce carbon footprints. Top load cartoning machines can accommodate sustainable materials, such as biodegradable and recyclable options, aligning with the growing consumer preference for environmentally responsible products. This shift towards sustainability is reflected in the packaging market, which is projected to reach a value of 400 billion dollars by 2027. Consequently, the demand for top load cartoning machines that support sustainable practices is likely to increase, as companies aim to meet regulatory requirements and consumer expectations.

Increased Focus on Product Safety and Integrity

In the Top Load Cartoning Machine Market, there is a heightened emphasis on product safety and integrity. As consumers become more health-conscious, manufacturers are compelled to ensure that their products are securely packaged to prevent contamination and damage. Top load cartoning machines provide robust packaging solutions that enhance product protection during transportation and storage. This focus on safety is reflected in the increasing investments in advanced packaging technologies, which are expected to reach a market value of over 50 billion dollars by 2026. Consequently, the demand for top load cartoning machines is likely to rise as companies prioritize the integrity of their products.

Rising Demand for Efficient Packaging Solutions

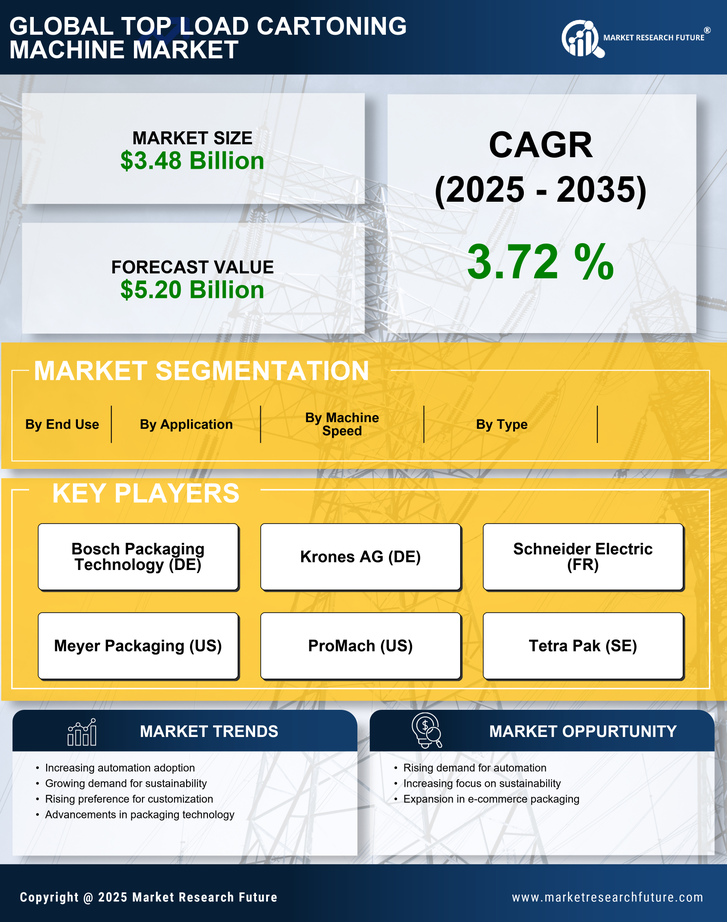

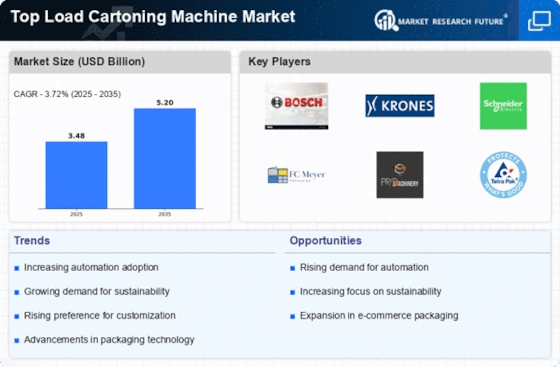

The Top Load Cartoning Machine Market is experiencing a surge in demand for efficient packaging solutions. As manufacturers strive to enhance productivity and reduce operational costs, the adoption of top load cartoning machines is becoming increasingly prevalent. These machines offer high-speed packaging capabilities, which are essential for meeting the growing consumer demand for packaged goods. According to recent data, the market for packaging machinery is projected to grow at a compound annual growth rate of approximately 4.5% over the next few years. This growth is driven by the need for automation and efficiency in production lines, making top load cartoning machines a vital component in modern manufacturing processes.

Technological Advancements in Packaging Machinery

The Top Load Cartoning Machine Market is significantly influenced by technological advancements in packaging machinery. Innovations such as smart sensors, IoT integration, and automation are transforming traditional packaging processes. These advancements enable manufacturers to optimize their production lines, reduce downtime, and improve overall efficiency. The introduction of Industry 4.0 concepts is further propelling the adoption of top load cartoning machines, as companies seek to leverage data analytics for better decision-making. As a result, the market for advanced packaging machinery is anticipated to grow, with top load cartoning machines playing a crucial role in this evolution.