Rising Demand for Renewable Energy

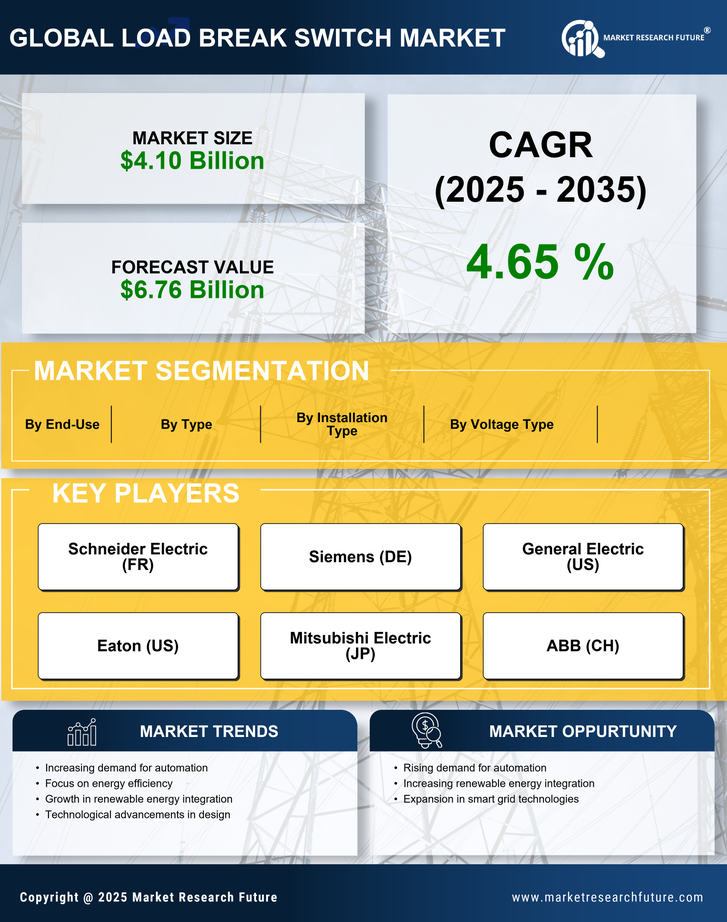

The increasing shift towards renewable energy sources is a pivotal driver for the Load Break Switch Market. As countries strive to meet energy transition goals, the integration of solar, wind, and other renewable sources into the grid necessitates reliable switching solutions. Load break switches play a crucial role in ensuring the safe operation of these energy systems. According to recent data, the renewable energy sector is projected to grow at a compound annual growth rate of over 8% in the coming years. This growth directly correlates with the demand for load break switches, as they are essential for managing the complexities of distributed energy resources. The Load Break Switch Market is thus positioned to benefit significantly from this trend, as utilities and energy providers seek to enhance grid reliability and safety.

Increased Focus on Safety Standards

The heightened emphasis on safety standards within the electrical distribution sector is a critical driver for the Load Break Switch Market. Regulatory bodies are continuously updating safety protocols to mitigate risks associated with electrical failures. This trend is particularly evident in regions where aging infrastructure poses significant safety challenges. The implementation of stringent safety regulations necessitates the adoption of reliable load break switches, which are designed to interrupt electrical circuits safely. Market data suggests that compliance with these safety standards could lead to a surge in demand for load break switches, as utilities and industries prioritize safety in their operations. Consequently, the Load Break Switch Market is likely to experience growth as organizations invest in compliant and advanced switching technologies.

Infrastructure Development Initiatives

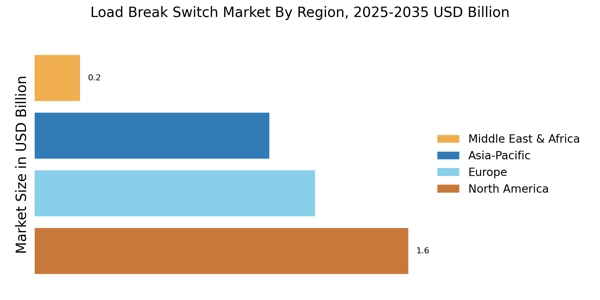

Infrastructure development initiatives across various regions are significantly influencing the Load Break Switch Market. Governments and private sectors are investing heavily in modernizing electrical grids and expanding transmission networks. This investment is driven by the need for improved energy efficiency and reliability. For instance, the International Energy Agency has indicated that investments in grid infrastructure could reach trillions of dollars over the next decade. Load break switches are integral components in these upgrades, facilitating safe and efficient operations. As new projects emerge, the demand for advanced load break switches is likely to rise, reflecting the industry's adaptation to evolving infrastructure needs. The Load Break Switch Market stands to gain from these developments, as enhanced infrastructure will require more sophisticated switching solutions.

Expansion of Electric Vehicle Infrastructure

The expansion of electric vehicle (EV) infrastructure is emerging as a significant driver for the Load Break Switch Market. As the adoption of electric vehicles accelerates, the need for robust charging infrastructure becomes paramount. Load break switches are essential in managing the electrical loads associated with EV charging stations, ensuring safe and efficient operations. Recent estimates indicate that the number of public charging stations is expected to increase substantially in the next few years, creating a corresponding demand for load break switches. This trend highlights the intersection of the automotive and electrical sectors, where the Load Break Switch Market can capitalize on the growing need for reliable switching solutions in EV infrastructure. The integration of load break switches into this expanding network is likely to enhance the overall safety and efficiency of electric vehicle charging systems.

Technological Innovations in Switching Solutions

Technological innovations are reshaping the Load Break Switch Market, driving the development of more efficient and reliable switching solutions. Advances in materials science and engineering have led to the creation of load break switches that offer enhanced performance and durability. For example, the introduction of smart load break switches equipped with monitoring capabilities allows for real-time data analysis and improved operational efficiency. Market analysts project that the adoption of such technologies will increase, as industries seek to optimize their electrical systems. This trend not only enhances the functionality of load break switches but also aligns with the broader movement towards smart grid technologies. As a result, the Load Break Switch Market is poised for growth, driven by the demand for innovative and intelligent switching solutions.