Rising Demand for Consumer Goods

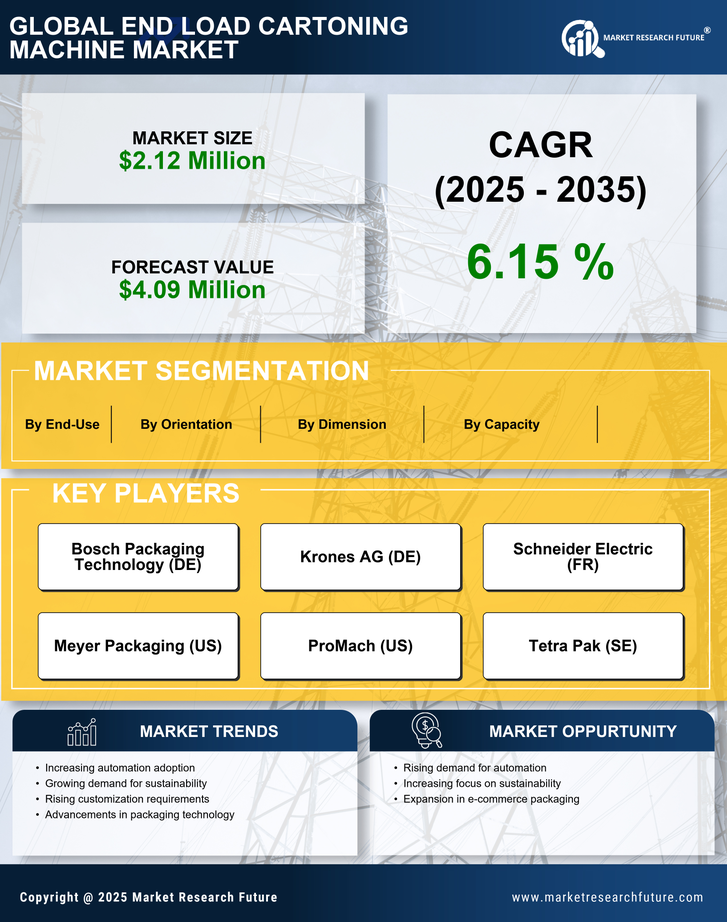

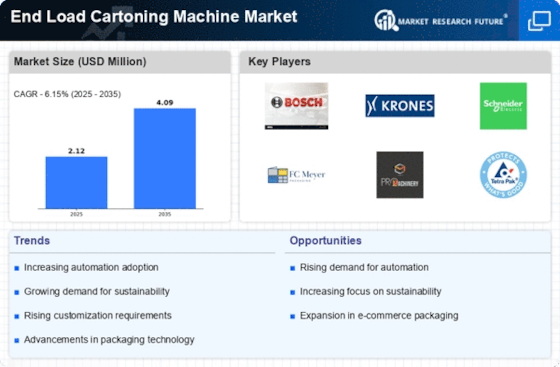

The End Load Cartoning Machine Market is experiencing a notable surge in demand driven by the increasing consumption of packaged consumer goods. As urbanization continues to rise, consumers are gravitating towards convenience, leading to a higher demand for ready-to-eat and packaged products. This trend is reflected in the packaging machinery sector, where the need for efficient cartoning solutions is paramount. The market for consumer goods is projected to grow at a compound annual growth rate (CAGR) of approximately 4.5% over the next few years, which in turn fuels the demand for end load cartoning machines. Manufacturers are thus compelled to invest in advanced cartoning technologies to meet this growing demand, ensuring that they remain competitive in the evolving marketplace.

Technological Advancements in Machinery

Technological innovations are significantly shaping the End Load Cartoning Machine Market. The introduction of smart technologies, such as IoT and AI, is enhancing the operational efficiency of cartoning machines. These advancements allow for real-time monitoring and predictive maintenance, which can reduce downtime and improve productivity. Furthermore, the integration of automation in packaging processes is becoming increasingly prevalent, with many companies adopting automated cartoning solutions to streamline operations. As a result, the market for end load cartoning machines is expected to witness a robust growth trajectory, with an estimated increase in market size by 6% annually over the next five years. This trend indicates a shift towards more sophisticated and efficient packaging solutions.

Customization and Personalization Trends

The End Load Cartoning Machine Market is witnessing a trend towards customization and personalization in packaging. As brands strive to differentiate themselves in a competitive landscape, the ability to offer tailored packaging solutions is becoming increasingly important. This trend is particularly evident in sectors such as cosmetics and food, where unique packaging can enhance product appeal. The demand for customizable cartoning solutions is expected to rise, with market analysts predicting a growth rate of approximately 4% annually. This shift necessitates that manufacturers of end load cartoning machines develop flexible systems capable of accommodating various sizes and designs, thereby meeting the diverse needs of their clients.

Focus on Sustainable Packaging Solutions

Sustainability is becoming a critical focus within the End Load Cartoning Machine Market. As consumers become more environmentally conscious, there is a growing demand for sustainable packaging solutions that minimize waste and utilize recyclable materials. Companies are increasingly adopting eco-friendly practices, which include the use of biodegradable and recyclable materials in their packaging processes. This shift is not only beneficial for the environment but also aligns with consumer preferences, thereby enhancing brand loyalty. The market for sustainable packaging is projected to grow at a CAGR of 5% in the coming years, indicating a strong potential for end load cartoning machines that support sustainable practices. Manufacturers are thus encouraged to innovate and adapt their machinery to meet these evolving demands.

Regulatory Compliance and Safety Standards

Regulatory compliance is a significant driver in the End Load Cartoning Machine Market. As governments and regulatory bodies impose stricter safety and quality standards, manufacturers are compelled to ensure that their packaging processes adhere to these regulations. This includes compliance with food safety standards, which is particularly crucial in the food and beverage sector. The need for reliable and safe packaging solutions is paramount, as non-compliance can lead to severe penalties and damage to brand reputation. Consequently, the market for end load cartoning machines is likely to expand as companies invest in machinery that meets these stringent requirements. Analysts estimate that adherence to regulatory standards could contribute to a market growth rate of around 3.5% over the next few years.