Energy Efficient Windows Size

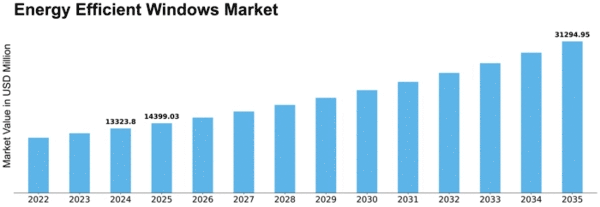

Energy Efficient Windows Market Growth Projections and Opportunities

Several variables affect the Energy Efficient Windows market. An important driver is the worldwide focus on sustainable and energy-efficient construction practices, where energy-efficient windows improve building energy efficiency. Demand for windows that increase insulation, heat loss or gain, and energy efficiency is rising as environmental awareness and energy conservation expand. These windows improve interior comfort, save heating and cooling energy, and support sustainable building. Technology in window manufacturing drives the Energy Efficient Windows business. Improvements to window thermal efficiency, glazing technology, and frame materials are under development. Architecture, builders, and homeowners require energy-efficient windows, therefore low-emissivity coatings, numerous glass layers, and thermally fractured frames are developed. Design choices and architectural trends shape the Energy Efficient Windows industry. The quest for energy-efficient, attractive windows has led to a vast variety of designs, sizes, and materials. The market offers conventional double-hung windows and contemporary, large-pane designs to fulfill the aesthetic and practical needs of various architectural types. Construction investment and government incentives affect Energy Efficient Windows sales. Economic stability and ongoing building investment boost energy-efficient window uptake. Conversely, economic downturns or construction expenditure variations may reduce or postpone projects, lowering high-performance window demand. Energy Efficient Windows market dynamics are shaped by window manufacturer competition. Research and development help companies build new window products, boost energy efficiency, and fulfill construction industry standards. Gaining market share and influencing construction project adoption of energy-efficient window solutions requires strong collaborations with architects, contractors, and developers. Consumer education regarding energy-efficient windows boosts the market. Energy-efficient windows grow increasingly popular as homeowners and builders learn about their energy savings, comfort, and cost savings. Educational programs, energy efficiency labeling, and case studies help promote energy-efficient windows for household and commercial use.

Leave a Comment