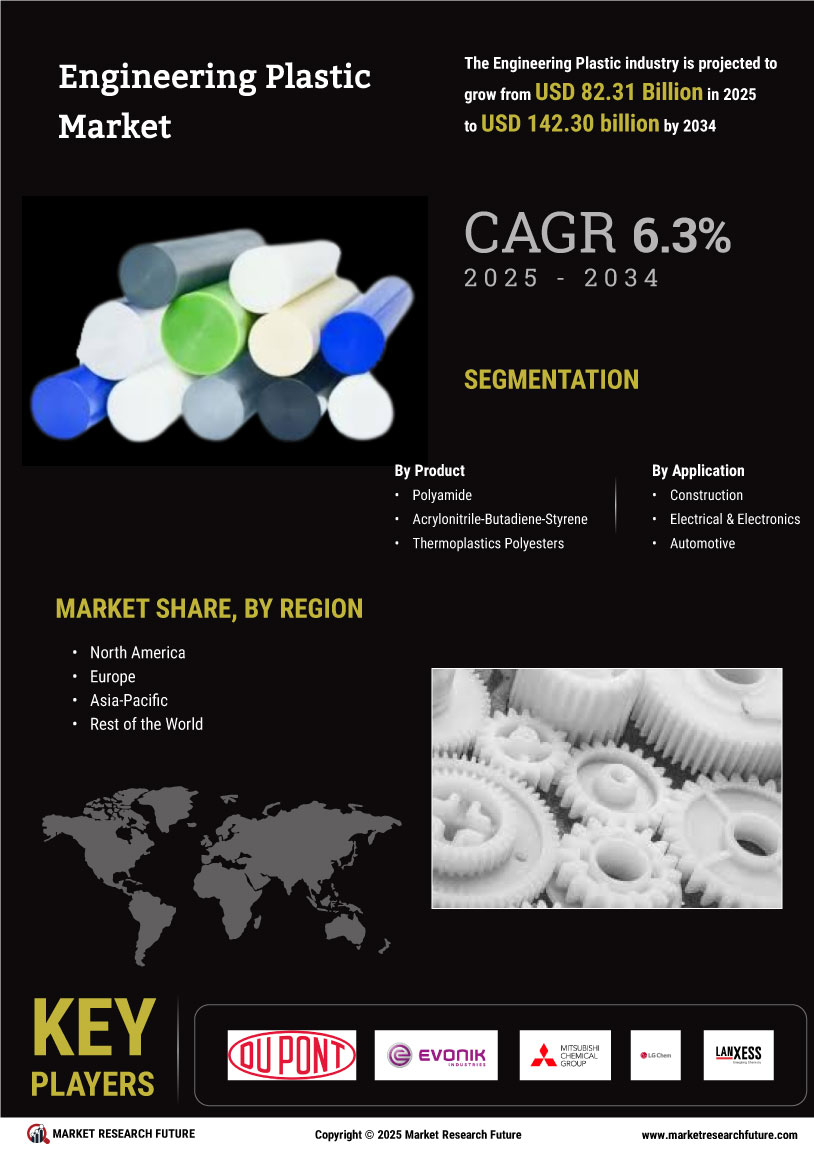

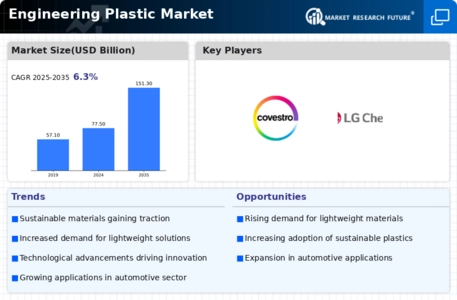

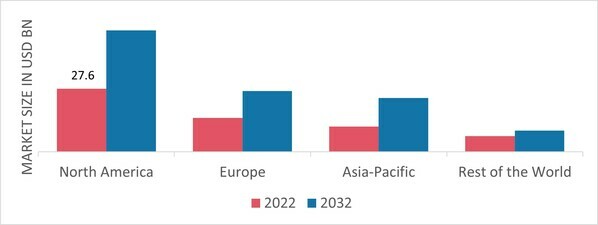

Leading market players are investing heavily in research and development to expand their product lines, which will help the Engineering Plastic market grow even more. Market participants are also undertaking various strategic activities to expand their footprint, with important market developments including new product launches, contractual agreements, mergers and acquisitions, higher investments, and collaboration with other organizations. The engineering plastic industry must offer cost-effective items to expand and survive in a more competitive and rising market climate.

Manufacturing locally to minimize operational costs is one of the key business tactics manufacturers use in the Engineering Plastic industry to benefit clients and increase the market sector. The Engineering Plastic industry has offered some of the most significant advantages in recent years. Major players in the Engineering Plastic market, including BASF SE (Germany), Covestro (Germany), Solvay S. A. (Belgium), Celanese Corporation (U.S.), E.

I. du Pont de Nemours and Company (U.S.), LG Chem Ltd. (South Korea), Saudi Basic Industries Corporation (Saudi Arabia), Evonik Industries AG (Germany), Lanxess AG (Germany), and Mitsubishi Engineering-Plastics Corporation (Japan), and others, are attempting to increase market demand by investing in research and development operations.

Saudi Arabia's Basic Industries Corporation, known as SABIC, is a Saudi chemical manufacturing company. Saudi Aramco owns 70% of SABIC's shares. It is active in petrochemicals, chemicals, industrial polymers, fertilizers, and metals. SABIC, a leading manufacturer of engineering plastics, recently added new products to their existing range. They introduced four new grades of chemically resistant LNP CRX polycarbonate (PC) copolymer resins to expand their portfolio of engineering plastics.

Solvay is a long-established chemical company that was founded in Belgium in 1863. The company is headquartered in Brussels, Belgium, and has announced the completion of a new thermoplastic composites (TPC) manufacturing plant in Greenville, South Carolina. The facility is expected to help the company expand its TPC production capabilities and bring new products to market.

Clariant is excited to present its latest innovations at Chinaplas 2024, currently happening in Shanghai, China. These technologies aim to assist the plastics sector improve safety and efficiency, encourage circularity, and reduce waste. The new AddWorks PPA polymer additive range not only provides smooth and steady processability but also eliminates sharkskin to guarantee the highest possible optical film properties.

Polyplastics, a Japanese provider of engineering thermoplastics, will launch a new high-performance thermoplastic in 2023 in addition to the ground-breaking sustainability initiative at Fakuma in Friedrichshafen, Germany. The company will present its latest product range and discuss how it meets industry standards for electronics, medical, and automotive as well as environmental sustainability.