Market Growth Projections

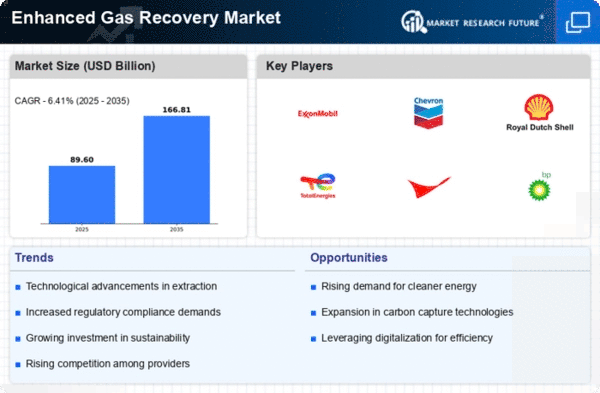

The Global Enhanced Gas Recovery Market Industry is poised for substantial growth, with projections indicating a market size of 84.2 USD Billion in 2024 and an anticipated increase to 156.6 USD Billion by 2035. This growth trajectory suggests a compound annual growth rate (CAGR) of 5.81% from 2025 to 2035. Such projections reflect the increasing adoption of enhanced gas recovery techniques, driven by rising energy demands, technological advancements, and supportive regulatory frameworks. The market's expansion is indicative of the industry's resilience and adaptability in meeting the evolving energy landscape.

Technological Advancements

Technological innovation plays a crucial role in the Global Enhanced Gas Recovery Market Industry, as advancements in extraction techniques enhance efficiency and reduce costs. Innovations such as improved drilling technologies, advanced seismic imaging, and enhanced recovery methods are being integrated into gas extraction processes. These developments not only increase the yield from existing gas fields but also lower the environmental impact associated with gas extraction. The adoption of these technologies is likely to drive market growth, as companies seek to optimize their operations and maximize profitability. The anticipated CAGR of 5.81% from 2025 to 2035 underscores the importance of technology in shaping the future of the industry.

Rising Global Energy Demand

The Global Enhanced Gas Recovery Market Industry is experiencing a surge in demand driven by the increasing global energy requirements. As populations grow and economies expand, the need for reliable and sustainable energy sources becomes paramount. Enhanced gas recovery techniques are being adopted to maximize the extraction of natural gas from existing fields, thus meeting the rising energy demands. In 2024, the market is projected to reach 84.2 USD Billion, reflecting the industry's response to this escalating demand. This trend is expected to continue, with the market potentially reaching 156.6 USD Billion by 2035, indicating a robust growth trajectory.

Investment in Infrastructure Development

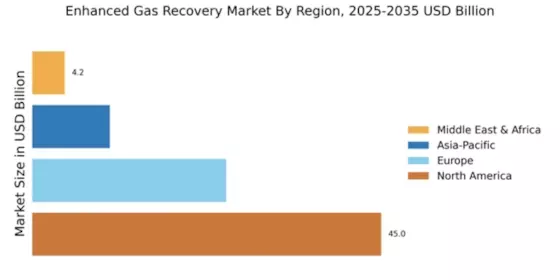

Investment in infrastructure development is a significant driver for the Global Enhanced Gas Recovery Market Industry. As countries strive to enhance their energy security and reduce dependence on imports, substantial investments are being made in gas extraction and transportation infrastructure. This includes the construction of pipelines, processing facilities, and storage systems that facilitate the efficient distribution of natural gas. Such investments not only bolster the market but also create job opportunities and stimulate economic growth. The focus on enhancing infrastructure is expected to support the market's expansion, particularly in regions with untapped gas reserves.

Environmental Regulations and Sustainability

The Global Enhanced Gas Recovery Market Industry is increasingly influenced by stringent environmental regulations aimed at reducing carbon emissions and promoting sustainable practices. Governments worldwide are implementing policies that encourage the adoption of cleaner energy sources, including natural gas, which is viewed as a transitional fuel. Enhanced gas recovery methods align with these sustainability goals by enabling more efficient extraction and utilization of natural gas resources. As companies adapt to comply with these regulations, the market is likely to witness growth, driven by the need for environmentally responsible practices in energy production.

Growing Interest in Natural Gas as a Transition Fuel

The Global Enhanced Gas Recovery Market Industry is benefiting from the growing recognition of natural gas as a transition fuel in the shift towards renewable energy sources. As countries aim to reduce their carbon footprints, natural gas is increasingly viewed as a cleaner alternative to coal and oil. Enhanced gas recovery techniques enable the efficient extraction of natural gas, thereby supporting its role in the global energy transition. This trend is likely to drive market growth, as governments and industries invest in technologies that enhance gas recovery and promote the use of natural gas in various applications.