Market Analysis

In-depth Analysis of Enterprise Data Integration Market Industry Landscape

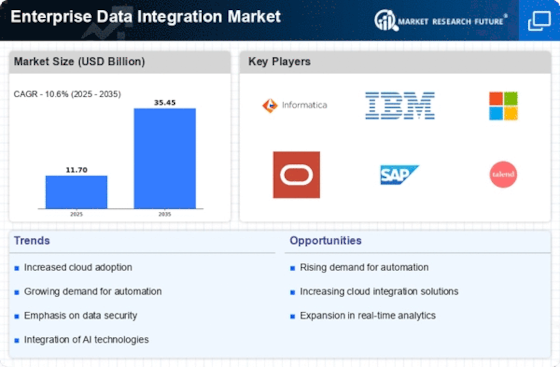

The Enterprise Data Integration market is undergoing dynamic changes, spurred by the escalating need for seamless and efficient data connectivity across diverse systems and applications within organizations. Data integration involves the process of combining, transforming, and managing data from various sources to provide a unified view for better decision-making. The market dynamics are shaped by several key factors, with the increasing volume and complexity of data generated by businesses standing out as a primary driver.

One significant influence on market dynamics is the data-driven nature of modern enterprises. As organizations accumulate vast amounts of data from diverse sources such as customer interactions, transactions, and IoT devices, the challenge lies in harnessing this data for actionable insights. Enterprise Data Integration solutions facilitate the flow of data across different systems, databases, and applications, enabling organizations to achieve a cohesive and comprehensive view of their data. The demand for these solutions is intensifying as businesses recognize the pivotal role of data integration in driving informed decision-making and gaining a competitive edge.

The rapid adoption of cloud computing is another pivotal factor shaping the dynamics of the Enterprise Data Integration market. With the proliferation of cloud-based applications and platforms, organizations are seeking integration solutions that can seamlessly connect on-premises systems with cloud services. Cloud-based data integration solutions offer flexibility, scalability, and accessibility, enabling businesses to adapt to dynamic market conditions and evolving technology landscapes. The shift towards cloud-based infrastructures is a transformative force influencing the market dynamics of Enterprise Data Integration.

Moreover, the imperative for real-time data access and analysis is driving the demand for Enterprise Data Integration solutions. In the era of instant decision-making, organizations require up-to-date and accurate information to respond swiftly to market changes. Data integration solutions that provide real-time or near-real-time data processing capabilities are gaining prominence. These solutions enable organizations to extract actionable insights from their data in a timely manner, enhancing operational efficiency and responsiveness. The need for real-time data integration is thus shaping the market dynamics as organizations prioritize agility and data-driven decision-making.

The increasing focus on data governance and regulatory compliance is another factor influencing the market dynamics of Enterprise Data Integration. As data privacy regulations become more stringent, organizations are compelled to implement robust data governance practices and ensure compliance with laws such as GDPR and CCPA. Data integration solutions play a crucial role in facilitating data governance by providing visibility into data lineage, ensuring data quality, and enforcing security measures. The demand for data integration tools that align with regulatory requirements is a key driver shaping the market dynamics.

However, challenges such as data silos, complexity in integration processes, and the need for skilled professionals persist. Organizations often grapple with disparate data sources and systems that hinder the seamless flow of information. Vendors in the Enterprise Data Integration market are addressing these challenges by offering solutions that support a wide range of data formats, employ intuitive interfaces, and provide features for data mapping and transformation. Additionally, efforts are being made to enhance automation in integration processes, reducing the dependence on manual intervention.

Leave a Comment