Enterprise Data Integration Size

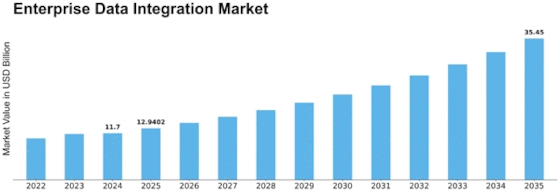

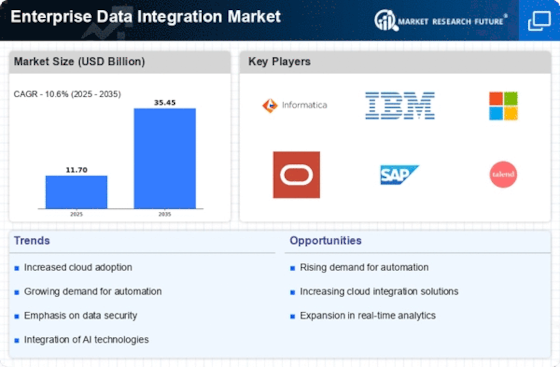

Enterprise Data Integration Market Growth Projections and Opportunities

Within the dynamic landscape of the Enterprise Data Integration Market, companies strategically deploy various market share positioning strategies to establish prominence and succeed in a competitive environment. As businesses increasingly recognize the importance of seamless data integration for efficient operations, strategic planning becomes essential for companies offering enterprise data integration solutions.

A prevalent strategy in the Enterprise Data Integration Market is differentiation through technology and features. With numerous players in the market, companies strive to set themselves apart by offering advanced data integration solutions. This involves the incorporation of cutting-edge technologies such as cloud integration, real-time data processing, and artificial intelligence into their platforms. By providing innovative features like automated data cleansing, ETL (Extract, Transform, Load) processes, and support for a variety of data sources, companies can attract clients seeking comprehensive and state-of-the-art data integration solutions.

Cost leadership is another crucial strategy embraced by companies in the Enterprise Data Integration Market. Given the cost-conscious nature of technology investments, providing cost-effective data integration solutions is vital for market share expansion. Companies focus on optimizing their processes, leveraging economies of scale, and offering flexible pricing models to provide high-quality data integration services at competitive prices. This not only appeals to clients looking to streamline their data processes cost-effectively but also allows companies to reach a broader customer base.

Strategic partnerships and collaborations play a pivotal role in market positioning within the Enterprise Data Integration Market. Recognizing the interconnected nature of data management and IT ecosystems, companies often form alliances with cloud service providers, database vendors, and industry-specific partners. Collaborative efforts enhance the overall value proposition of enterprise data integration services by ensuring compatibility with a variety of systems and applications. These partnerships not only expand market reach but also foster innovation through the exchange of expertise and resources.

Market segmentation is a tailored strategy frequently employed in the Enterprise Data Integration Market. Acknowledging the diverse needs of industries such as finance, healthcare, and e-commerce, companies customize their data integration solutions to address specific verticals. This focused approach allows companies to cater to the unique requirements of each sector effectively. By understanding and meeting the distinct demands of different industries, companies can position themselves as specialists in particular niches, capturing market share within those targeted segments.

Technological adaptation is fundamental to maintaining a competitive edge in the dynamic Enterprise Data Integration Market. The industry experiences rapid advancements in data integration technologies, including the rise of hybrid and multi-cloud integration, real-time data processing, and the increasing use of APIs (Application Programming Interfaces). Companies that stay ahead of these technological shifts and incorporate the latest features and capabilities into their data integration solutions are better positioned to meet the evolving needs of their clients. This adaptability ensures that enterprise data integration remains relevant and competitive in a landscape where digital transformation is integral to business operations.

Leave a Comment