Adoption of Cloud-Based Solutions

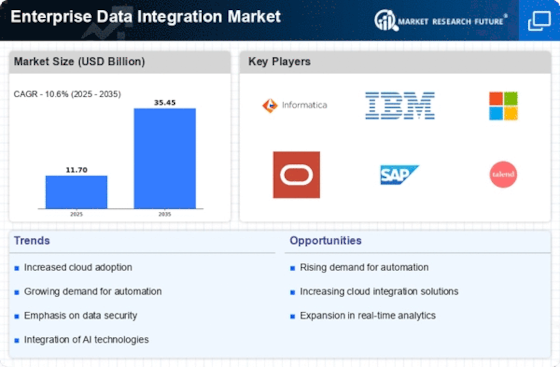

The shift towards cloud-based solutions is a pivotal driver in the Enterprise Data Integration Market. Organizations are increasingly migrating their data and applications to the cloud, seeking scalability, flexibility, and cost-effectiveness. This transition is expected to result in a substantial increase in the demand for cloud integration services, with the market anticipated to reach several billion dollars by the end of the decade. Cloud-based data integration platforms enable businesses to connect disparate data sources effortlessly, enhancing collaboration and data accessibility. As enterprises continue to embrace digital transformation, the reliance on cloud solutions for data integration is likely to intensify, further propelling the growth of the Enterprise Data Integration Market.

Emergence of Advanced Technologies

The emergence of advanced technologies such as artificial intelligence and machine learning is reshaping the Enterprise Data Integration Market. These technologies enable organizations to automate data integration processes, enhancing efficiency and accuracy. The integration of AI-driven analytics into data integration platforms is expected to provide deeper insights and predictive capabilities, which are increasingly sought after by businesses. Market analysts suggest that the adoption of AI in data integration could lead to a reduction in operational costs by up to 20%. As enterprises seek to leverage these advanced technologies, the demand for innovative data integration solutions is likely to escalate, thereby driving growth in the Enterprise Data Integration Market.

Focus on Data Governance and Compliance

In the current landscape, the emphasis on data governance and compliance is becoming increasingly pronounced within the Enterprise Data Integration Market. Organizations are compelled to adhere to stringent regulations regarding data privacy and security, such as GDPR and CCPA. This regulatory environment necessitates robust data integration solutions that ensure data integrity and compliance. As a result, the market for data governance tools is projected to expand significantly, with estimates suggesting a growth rate of over 25% in the next few years. Companies are investing in enterprise data integration solutions that not only streamline data management but also enhance compliance capabilities, thereby driving the overall growth of the Enterprise Data Integration Market.

Increased Demand for Real-Time Analytics

The Enterprise Data Integration Market is experiencing a surge in demand for real-time analytics. Organizations are increasingly recognizing the value of timely data insights for decision-making. This trend is driven by the need for businesses to respond swiftly to market changes and customer preferences. According to recent estimates, the market for real-time analytics is projected to grow at a compound annual growth rate of over 30% in the coming years. This growth is likely to propel the adoption of enterprise data integration solutions that facilitate seamless data flow and processing. As companies strive to enhance operational efficiency, the integration of real-time data capabilities becomes paramount, thereby driving the overall growth of the Enterprise Data Integration Market.

Growing Need for Data-Driven Decision Making

The growing need for data-driven decision making is a fundamental driver in the Enterprise Data Integration Market. Organizations are increasingly relying on data to inform strategic decisions, optimize operations, and enhance customer experiences. This trend is reflected in the rising investments in data integration solutions, with projections indicating a market value exceeding several billion dollars in the near future. As businesses recognize the importance of integrating diverse data sources to gain comprehensive insights, the demand for effective data integration tools is likely to rise. Consequently, the Enterprise Data Integration Market is poised for substantial growth as organizations prioritize data-driven strategies to remain competitive.