Research Methodology on Enterprise Governance, Risk and Compliance Market

Introduction

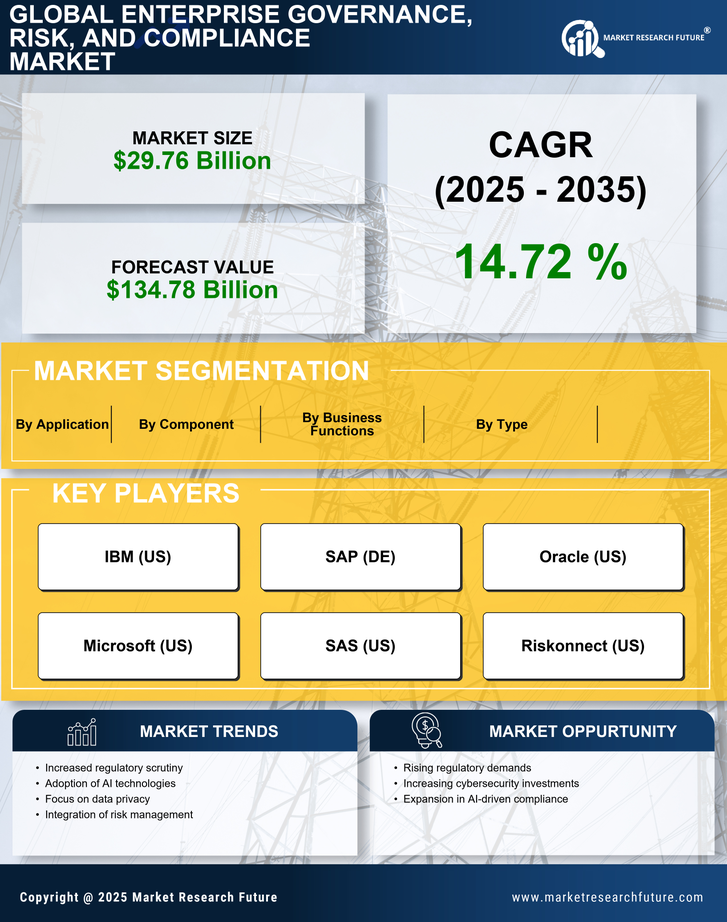

This research report focuses on the Enterprise Governance, Risk and Compliance (EGRC) market. The purpose of the report is to analyze the global trends and opportunities in the market, estimate market share and size in 2022, and forecast the growth rates up to 2030. Additionally, the report shall identify the drivers, restraints, trends and opportunities related to the sector and their level of impact on the industry. Several approaches such as secondary research, interviews, and market surveys shall be used in carrying out this work. The information collected is analyzed and presented in this report in the form of tables and figures which shall enable readers to gain a comprehensive understanding of the current and forecasted EGRC market.

- Research Design

- Research Process

The research process followed in this study consists of the following main steps –

Define market research objectives

Research methodology design

Data collection

Data analysis

- Research report

- Data Sources

The sources of data used in the research include both primary and secondary sources. Primary sources of data consist of Survey Questionnaires with Industrial Experts and Professionals, along with Interviews with C-Level Executives, Entrepreneurs, and Market Vendors. In addition to these, secondary sources of data used in the project include Corporate Financial Data, SEC Filings, News Websites, Factiva databases, Market Reports, Analyst Publications and Whitepapers, Government Documents and Regulatory Filings, Trade Journals, and Academic Journals.

Research Methodology

Quantitative and Qualitative research approaches are utilized in this study to analyze the market. The research process involves the following stages:

Secondary Research

In this stage, extensive secondary research is conducted to gather information and insights about the sector. The sources of secondary research used in the project include Corporate Financial Data, SEC Filings, News websites, Factiva databases, Market Reports, Analyst Publications and Whitepapers, Government Documents and Regulatory Filings, Trade Journals, and Academic Journals.

Primary Research

In the primary research phase, the respondents are selected from different industry stakes who have an in-depth understanding of the sector. The method utilized for selecting the interviewees includes,

- Using business directories such as Bloomberg, Reuters, Hoovers, and ASR

- Using Trade Associations of relevant industry

- Through Searches on Online Databases

- Referrals and Networking

The survey questionnaires used for primary research include both closed-ended and open-ended questions. The information generated from the surveys is cross-checked with the sources of secondary research to verify the accuracy of the results.

Target Population

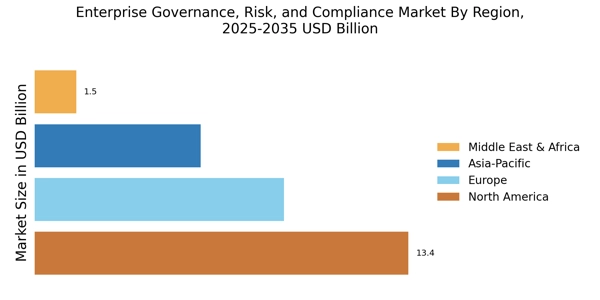

The target population selected for this project comprises regions located in North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa.

Sample Unit

The sample size selected for the project consists of key stakeholders including vendors, users, industry experts, distributors, and professionals of the EGRC industry located across the aforementioned regions.

Sampling Method

The sampling method selected for the project is purposive sampling. In this type of sampling, the selection of the sample is based on predetermined criteria. It is also known as judgmental, selective, or subjective sampling. The study focused on selecting respondents possessing knowledge about the market dynamics and provided an unbiased opinion on the market.

Data Collection and Analysis

Data Collection

The primary data collection methods used for the project include quantitative surveys with respondents and qualitative interviews with industry experts. The collected information is then analyzed and presented with the help of various graphical representations such as tables, scatter plots, and charts.

Data Analysis

The collected data is analyzed in two ways,

Descriptive

This type of analysis is conducted to review, tabulate, and describe the previously collected data. The analysis is done to describe the structure, categorization, and trends in the data.

Inferential

Inferential analysis is used to understand the characteristics of a given population by making inferences and predictions based on sample data collected. Predictive models and statistical tests are used for understanding the relationships between variables.

Conclusion

This research report provides an analysis of the current and future trends of the global EGRC market based on primary and secondary research. Stakeholder interviews and surveys are conducted to collect data regarding the market and its trends which are used to analyze the market and generate insights. The data collected is validated using other secondary sources, and presented in the form of various graphical representations. Thus, the report provides insight into the EGRC market and would be useful for stakeholders in better decision-making.