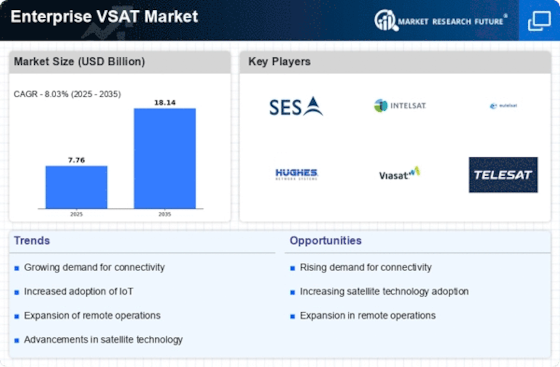

The Enterprise VSAT Market is currently characterized by a dynamic competitive landscape, driven by the increasing demand for reliable satellite communication solutions across various sectors, including telecommunications, maritime, and energy. Key players such as SES S.A. (LU), Intelsat S.A. (US), and Hughes Network Systems, LLC (US) are strategically positioning themselves through innovation and partnerships. SES S.A. has focused on enhancing its service offerings by investing in next-generation satellite technology, while Intelsat S.A. has pursued strategic alliances to expand its global footprint. Hughes Network Systems, on the other hand, emphasizes digital transformation to improve service delivery and customer experience, collectively shaping a competitive environment that prioritizes technological advancement and customer-centric solutions. The market structure appears moderately fragmented, with several players vying for market share. Key business tactics include localizing manufacturing and optimizing supply chains to enhance operational efficiency. This fragmentation allows for a diverse range of offerings, yet the influence of major players remains significant, as they leverage their resources to establish competitive advantages. The collective strategies of these companies indicate a trend towards consolidation, as they seek to enhance their market positions through mergers and acquisitions. In August 2025, Viasat, Inc. (US) announced a partnership with a leading telecommunications provider to enhance broadband services in underserved regions. This strategic move is likely to bolster Viasat's market presence and address the growing demand for connectivity in remote areas, aligning with the broader trend of digital inclusion. The partnership underscores Viasat's commitment to expanding its service capabilities and enhancing customer access to high-speed internet. In September 2025, Eutelsat Communications S.A. (FR) launched a new satellite designed to improve coverage and capacity for enterprise customers. This initiative reflects Eutelsat's focus on innovation and its intent to capture a larger share of the enterprise market. By enhancing its satellite capabilities, Eutelsat positions itself as a key player in providing robust communication solutions, which is essential for businesses operating in data-intensive environments. In October 2025, Telesat Canada (CA) announced the successful deployment of its low Earth orbit (LEO) satellite constellation, aimed at delivering high-speed internet services globally. This development is pivotal as it signifies Telesat's entry into the competitive LEO market, which is expected to revolutionize satellite communications. The deployment not only enhances Telesat's service offerings but also positions the company to compete effectively against established players in the rapidly evolving VSAT landscape. As of October 2025, current competitive trends in the Enterprise VSAT Market are increasingly defined by digitalization, sustainability, and the integration of artificial intelligence. Strategic alliances are becoming more prevalent, as companies recognize the need to collaborate to enhance service offerings and operational efficiencies. Looking ahead, competitive differentiation is likely to evolve from traditional price-based competition to a focus on innovation, technology, and supply chain reliability, as companies strive to meet the growing demands of a digitally connected world.