Corporate Sustainability Initiatives

The growing emphasis on corporate sustainability initiatives is a key driver for the Environment Testing Service Market. Companies are increasingly recognizing the importance of integrating sustainable practices into their operations, not only to comply with regulations but also to enhance their brand reputation. This shift is leading to a greater reliance on environmental testing services to assess the impact of their activities on the environment. Many organizations are setting ambitious sustainability goals, such as achieving net-zero emissions, which necessitates regular environmental assessments. Consequently, the market for testing services is likely to expand as businesses seek to validate their sustainability claims and ensure compliance with evolving environmental standards.

Increasing Environmental Regulations

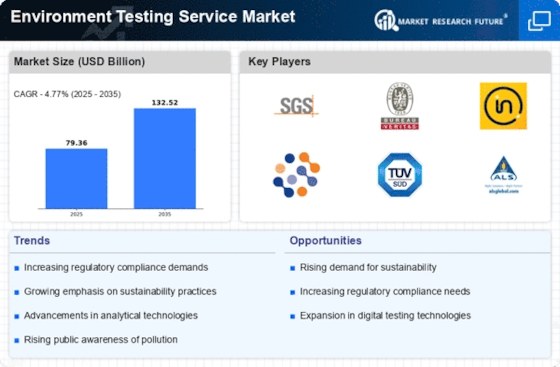

The Environment Testing Service Market is experiencing a surge in demand due to the tightening of environmental regulations across various sectors. Governments are implementing stricter guidelines to monitor and control pollution levels, which necessitates comprehensive testing services. For instance, the introduction of new legislation aimed at reducing carbon emissions has compelled industries to adopt rigorous testing protocols. This regulatory landscape not only drives the need for environmental testing but also encourages companies to invest in sustainable practices. As a result, the market for environment testing services is projected to grow significantly, with estimates suggesting a compound annual growth rate of over 7% in the coming years. This trend indicates a robust opportunity for service providers to expand their offerings and cater to the evolving compliance requirements.

Investment in Renewable Energy Projects

Investment in renewable energy projects is significantly influencing the Environment Testing Service Market. As nations strive to transition towards sustainable energy sources, there is an increasing need for environmental assessments related to renewable energy installations, such as wind farms and solar power plants. These projects require comprehensive testing to evaluate their environmental impact and ensure compliance with regulatory standards. The growth of the renewable energy sector is expected to drive demand for specialized testing services, as developers seek to mitigate potential environmental risks associated with their projects. This trend indicates a promising avenue for growth within the environment testing services market, as stakeholders prioritize environmental stewardship in their energy initiatives.

Technological Innovations in Testing Methods

Technological advancements are revolutionizing the Environment Testing Service Market, enhancing the efficiency and accuracy of testing methods. Innovations such as real-time monitoring systems and advanced analytical techniques are enabling more precise assessments of environmental conditions. For example, the integration of artificial intelligence and machine learning in data analysis allows for quicker identification of pollutants and more effective remediation strategies. These technological improvements not only streamline testing processes but also reduce costs for service providers and clients alike. As industries increasingly adopt these cutting-edge technologies, the demand for sophisticated environmental testing services is expected to rise, further propelling market growth.

Rising Public Awareness of Environmental Issues

Public awareness regarding environmental issues is on the rise, significantly impacting the Environment Testing Service Market. As communities become more informed about the implications of pollution and climate change, there is an increasing demand for transparency and accountability from corporations. This heightened awareness drives businesses to seek environmental testing services to ensure compliance with environmental standards and to demonstrate their commitment to sustainability. Furthermore, consumer preferences are shifting towards eco-friendly products, prompting companies to validate their environmental claims through rigorous testing. This trend is likely to bolster the market, as organizations recognize the importance of maintaining a positive public image and the potential financial benefits associated with sustainable practices.