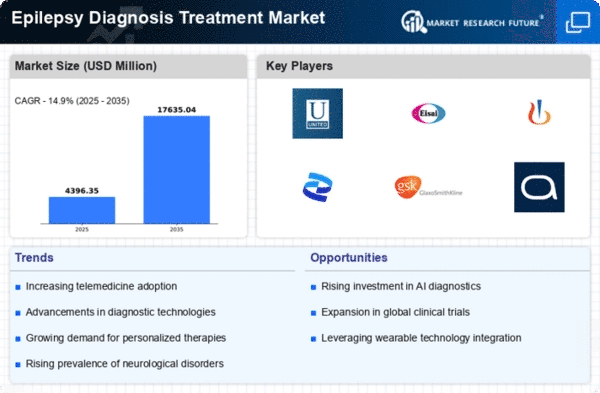

Market Growth Projections

The Global Epilepsy Diagnosis and Treatment Market Industry is projected to experience substantial growth over the coming years. With a market value of 3.83 USD Billion in 2024, it is anticipated to reach 17.6 USD Billion by 2035. This growth trajectory indicates a robust compound annual growth rate (CAGR) of 14.89% from 2025 to 2035. Such projections reflect the increasing demand for innovative diagnostic and treatment solutions, driven by factors such as rising prevalence, technological advancements, and heightened awareness. The market's expansion is likely to create numerous opportunities for stakeholders across the healthcare spectrum.

Rising Prevalence of Epilepsy

The increasing prevalence of epilepsy globally serves as a primary driver for the Global Epilepsy Diagnosis and Treatment Market Industry. It is estimated that approximately 50 million people worldwide are affected by epilepsy, with a notable rise in cases due to factors such as urbanization and lifestyle changes. This growing patient population necessitates enhanced diagnostic tools and treatment options, thereby expanding market opportunities. The demand for effective management strategies is likely to escalate, contributing to the market's projected growth from 3.83 USD Billion in 2024 to an anticipated 17.6 USD Billion by 2035.

Increased Awareness and Education

Growing awareness and education regarding epilepsy contribute positively to the Global Epilepsy Diagnosis and Treatment Market Industry. Public health campaigns and initiatives aimed at reducing stigma associated with epilepsy have led to increased recognition of the condition. This heightened awareness encourages individuals to seek medical advice and diagnosis, thereby driving demand for treatment options. Furthermore, educational programs for healthcare professionals ensure that they are equipped with the latest knowledge and skills to manage epilepsy effectively. As awareness continues to expand, the market is likely to experience sustained growth.

Government Initiatives and Funding

Government initiatives and funding aimed at epilepsy research and treatment play a crucial role in shaping the Global Epilepsy Diagnosis and Treatment Market Industry. Various countries are implementing policies to enhance healthcare access and improve treatment options for epilepsy patients. Increased funding for research into new therapies and technologies is expected to yield innovative solutions, thereby expanding the market. For instance, government-backed programs that support clinical trials and public health initiatives are likely to foster a conducive environment for market growth, aligning with the projected CAGR of 14.89% from 2025 to 2035.

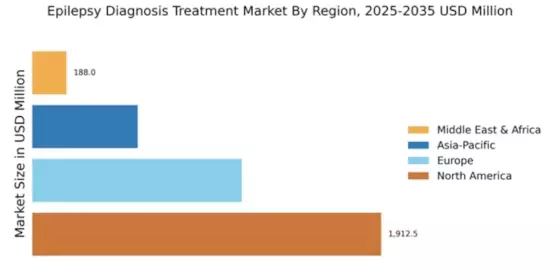

Emerging Markets and Economic Growth

The emergence of new markets and economic growth in developing regions significantly impacts the Global Epilepsy Diagnosis and Treatment Market Industry. As economies expand, there is a corresponding increase in healthcare expenditure, which facilitates access to advanced diagnostic and treatment options for epilepsy. Countries in Asia-Pacific and Latin America are witnessing rapid growth in healthcare infrastructure, leading to improved patient access to epilepsy care. This trend is expected to drive market expansion as more individuals receive timely diagnoses and effective treatments, contributing to the overall growth trajectory of the industry.

Advancements in Diagnostic Technologies

Technological advancements in diagnostic tools significantly influence the Global Epilepsy Diagnosis and Treatment Market Industry. Innovations such as high-resolution MRI, EEG monitoring, and genetic testing have improved the accuracy of epilepsy diagnosis, allowing for timely and effective treatment interventions. These advancements not only enhance patient outcomes but also facilitate personalized treatment plans, which are increasingly favored in modern healthcare. As the market adapts to these technological changes, the demand for sophisticated diagnostic equipment is expected to rise, further propelling market growth in the coming years.