Growing E-commerce Sector

The rapid expansion of the e-commerce sector is significantly impacting the advanced distribution-management-systems market in Europe. As online shopping continues to gain traction, businesses are compelled to adopt advanced distribution solutions to manage the complexities of e-commerce logistics. This includes handling increased order volumes, ensuring timely deliveries, and managing returns efficiently. Recent statistics indicate that e-commerce sales in Europe are expected to reach €500 billion by 2026, which will likely drive investments in advanced distribution-management systems. Companies are recognizing that efficient distribution is essential for maintaining competitiveness in the e-commerce landscape.

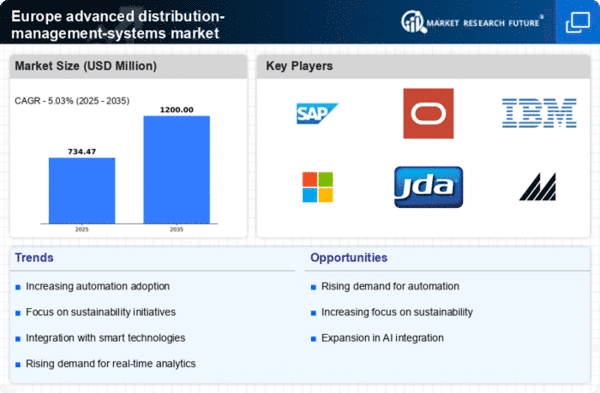

Rising Demand for Automation

The advanced distribution-management-systems market in Europe is experiencing a notable surge in demand for automation solutions. This trend is driven by the need for increased operational efficiency and reduced human error in distribution processes. Companies are increasingly adopting automated systems to streamline their supply chains, which can lead to cost savings and improved service levels. According to recent data, the automation segment within the advanced distribution-management-systems market is projected to grow at a CAGR of approximately 12% over the next five years. This growth reflects a broader shift towards digital transformation in logistics and distribution, as businesses seek to enhance their competitive edge in a rapidly evolving market.

Evolving Regulatory Frameworks

The advanced distribution-management-systems market in Europe is significantly influenced by evolving regulatory frameworks aimed at enhancing supply chain transparency and efficiency. Governments are implementing stricter regulations regarding data management, environmental sustainability, and operational safety. These regulations compel companies to adopt advanced distribution-management systems that comply with new standards. For instance, the European Union's Green Deal emphasizes sustainability in logistics, which may drive investments in systems that optimize resource use and minimize waste. As a result, businesses are likely to invest in advanced technologies to ensure compliance, thereby propelling market growth.

Increased Focus on Customer Experience

In the advanced distribution-management-systems market in Europe, there is a growing emphasis on enhancing customer experience through improved distribution strategies. Companies are recognizing that efficient distribution directly impacts customer satisfaction and loyalty. As a result, businesses are investing in advanced systems that provide real-time tracking, faster delivery times, and personalized services. Market analysis indicates that organizations prioritizing customer-centric distribution strategies are likely to see a 15% increase in customer retention rates. This focus on customer experience is driving the adoption of advanced distribution-management systems, as companies strive to meet the evolving expectations of consumers.

Technological Advancements in Logistics

Technological advancements are playing a crucial role in shaping the advanced distribution-management-systems market in Europe. Innovations such as the Internet of Things (IoT), blockchain, and big data analytics are transforming how distribution processes are managed. These technologies enable real-time monitoring, enhanced data security, and improved decision-making capabilities. As businesses increasingly leverage these technologies, the market is expected to witness substantial growth. For instance, the integration of IoT in distribution systems is projected to enhance operational efficiency by up to 20%, thereby driving demand for advanced distribution-management solutions.

Leave a Comment