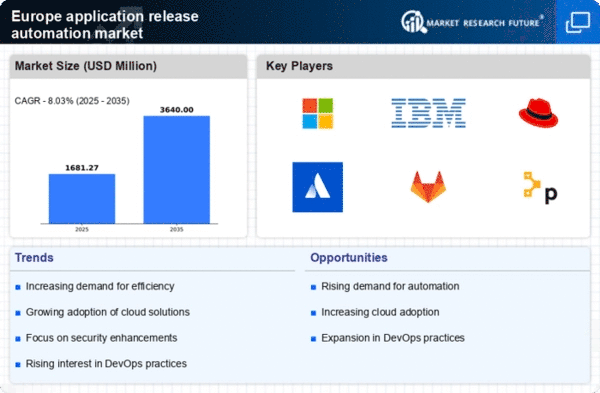

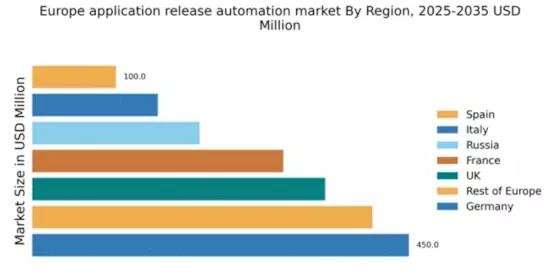

Germany : Strong Demand and Innovation Hub

Germany holds a dominant position in the application release-automation market, accounting for 30% of the total European market with a value of $450.0 million. Key growth drivers include a robust industrial base, increasing digital transformation initiatives, and government support for technology adoption. The demand for automation is fueled by the need for efficiency and speed in software deployment, alongside favorable regulatory policies promoting innovation and investment in IT infrastructure.

UK : Innovation and Investment Drive Success

The UK represents 25% of the European market, valued at $350.0 million, driven by a strong focus on cloud computing and agile methodologies. The demand for application release automation is rising as businesses seek to enhance operational efficiency and reduce time-to-market. Government initiatives, such as the Digital Strategy, encourage tech adoption, while a skilled workforce supports innovation in automation technologies.

France : Strong Market with Diverse Applications

France captures 20% of the European market, valued at $300.0 million, with growth driven by increasing investments in digital transformation and a focus on DevOps practices. The French government promotes innovation through various initiatives, including tax incentives for tech startups. Demand is particularly strong in sectors like finance and telecommunications, where rapid deployment is critical.

Russia : Regulatory Landscape Influences Growth

Russia holds a 13.3% share of the European market, valued at $200.0 million. Key growth drivers include a push for modernization in IT infrastructure and increased demand for automation in various industries. However, regulatory challenges and geopolitical factors can impact market dynamics. The government is actively promoting digital initiatives to enhance competitiveness in the global market.

Italy : Focus on Efficiency and Innovation

Italy accounts for 10% of the European market, valued at $150.0 million, with growth driven by the need for operational efficiency in manufacturing and services. The Italian government supports digital transformation through initiatives aimed at enhancing IT infrastructure. Key cities like Milan and Rome are central to the market, with a growing presence of major players like IBM and Microsoft.

Spain : Investment in Digital Transformation

Spain represents 6.7% of the European market, valued at $100.0 million, with significant growth potential driven by increasing investments in technology and automation. The Spanish government is fostering a digital economy through various initiatives, encouraging businesses to adopt automation solutions. Key cities like Madrid and Barcelona are witnessing a surge in demand for application release automation.

Rest of Europe : Growth Across Multiple Nations

The Rest of Europe accounts for 27% of the market, valued at $406.3 million, showcasing diverse growth dynamics across various countries. Factors such as local regulations, economic conditions, and technological adoption rates influence market trends. Countries like the Netherlands and Sweden are leading in automation adoption, with significant investments from major players like Red Hat and Atlassian.