Increased Focus on Health and Wellness

The audio equipment market in Europe is witnessing a notable shift towards health and wellness. Consumers are increasingly aware of the impact of sound on mental well-being, leading to a rise in demand for products that promote relaxation and mindfulness. Audio equipment designed for meditation, sleep enhancement, and stress relief is gaining traction. In 2025, the wellness audio segment is anticipated to grow by 20%, indicating a strong market potential. This trend is encouraging manufacturers to innovate and develop products that cater to the health-conscious consumer. As the audio equipment market adapts to these changing consumer preferences, it is likely to see a diversification of product offerings aimed at enhancing overall well-being.

Rising Consumer Awareness and Education

The audio equipment market in Europe is benefiting from rising consumer awareness and education regarding audio quality and technology. As consumers become more informed about the differences between various audio formats and equipment, they are more likely to invest in higher-quality products. This trend is reflected in the increasing sales of premium audio equipment, which is projected to grow by 18% in 2025. Educational initiatives, such as workshops and online resources, are helping consumers understand the value of investing in quality audio solutions. Consequently, the audio equipment market is likely to see a shift towards more informed purchasing decisions, driving demand for advanced and high-fidelity audio products.

Growing Demand for Home Entertainment Systems

The audio equipment market in Europe is significantly influenced by the rising demand for home entertainment systems. With more consumers investing in home theaters and high-fidelity audio setups, the market is projected to expand. In 2025, the home audio segment is expected to account for over 30% of total audio equipment sales, reflecting a shift in consumer behavior towards premium audio experiences at home. This trend is further fueled by the increasing availability of streaming services that offer high-quality audio content. As consumers seek to replicate cinema-like experiences at home, the audio equipment market is poised for substantial growth, with manufacturers focusing on creating immersive sound systems that cater to this demand.

Technological Advancements in Audio Equipment

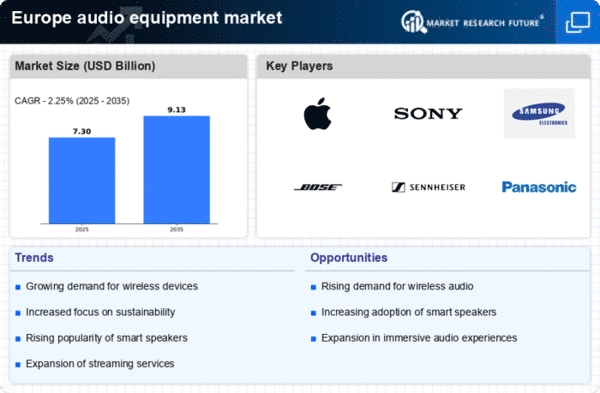

The audio equipment market in Europe is experiencing a surge due to rapid technological advancements. Innovations such as high-resolution audio formats and improved wireless technologies are enhancing sound quality and user experience. The integration of smart features, including voice assistants and connectivity with smart home devices, is becoming increasingly prevalent. In 2025, the market for wireless audio devices is projected to grow by approximately 15%, indicating a strong consumer preference for convenience and quality. Furthermore, advancements in noise-cancellation technology are attracting audiophiles and casual listeners alike, thereby expanding the market. As manufacturers continue to invest in research and development, the audio equipment market is likely to witness further growth driven by these technological innovations.

Expansion of Streaming Services and Content Creation

The audio equipment market in Europe is significantly impacted by the expansion of streaming services and content creation platforms. As more individuals engage in podcasting, music production, and live streaming, the demand for high-quality audio equipment is on the rise. In 2025, the market for professional audio equipment is expected to grow by 25%, driven by the increasing number of content creators seeking superior sound quality. This trend is prompting manufacturers to develop specialized equipment tailored for creators, such as microphones and audio interfaces. The audio equipment market is thus evolving to meet the needs of this burgeoning segment, fostering innovation and competition among brands.