Regulatory Compliance and Standards

Regulatory compliance plays a crucial role in shaping the automation testing market in Europe. Industries such as finance, healthcare, and telecommunications are subject to stringent regulations that mandate thorough testing of software applications. In 2025, compliance-related testing is expected to account for approximately 25% of the automation testing market. Organizations are increasingly adopting automated testing solutions to ensure adherence to these regulations, thereby reducing the risk of non-compliance penalties. The automation testing market is likely to thrive as companies prioritize compliance-driven testing strategies to meet legal and industry standards.

Adoption of Agile and DevOps Methodologies

The shift towards Agile and DevOps methodologies significantly influences the automation testing market in Europe. These frameworks promote collaboration and rapid development cycles, necessitating efficient testing processes. In 2025, approximately 70% of European organizations are expected to adopt Agile practices, leading to an increased reliance on automation testing tools. This transition allows for continuous integration and delivery, enabling teams to identify and resolve issues promptly. Consequently, the automation testing market is likely to expand as businesses seek tools that align with these methodologies, facilitating faster releases and improved software quality.

Growing Complexity of Software Applications

The increasing complexity of software applications is a driving force behind the automation testing market in Europe. As applications become more intricate, traditional testing methods struggle to keep pace. In 2025, it is estimated that over 60% of software projects will involve multi-platform environments, necessitating advanced testing solutions. Automation testing tools are essential for managing this complexity, allowing for comprehensive testing across various platforms and devices. The automation testing market is thus poised for growth, as organizations seek to implement solutions that can handle the demands of modern software development.

Rising Demand for Software Quality Assurance

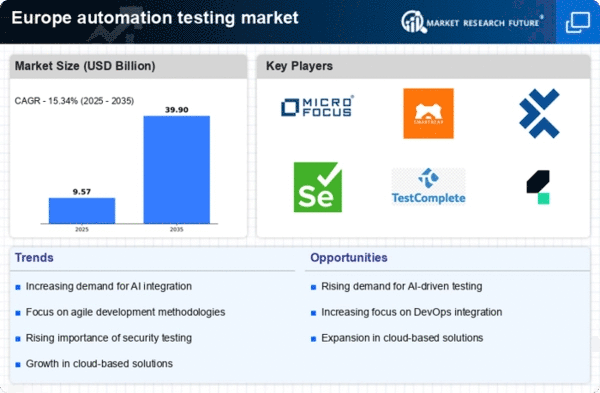

The automation testing market in Europe experiences a notable surge in demand for software quality assurance. As businesses increasingly rely on software applications, the need for robust testing solutions becomes paramount. In 2025, the market is projected to grow at a CAGR of 15%, driven by the necessity for high-quality software that meets user expectations. Companies are investing in automation testing tools to enhance efficiency and reduce time-to-market. This trend is particularly evident in sectors such as finance and healthcare, where software reliability is critical. The automation testing market is thus positioned to benefit from this growing emphasis on quality assurance, as organizations seek to mitigate risks associated with software failures.

Increased Investment in Digital Transformation

The ongoing digital transformation across various sectors significantly impacts the automation testing market in Europe. Organizations are investing heavily in digital initiatives to enhance customer experiences and operational efficiency. In 2025, it is projected that European companies will allocate over €50 billion towards digital transformation efforts, with a substantial portion directed towards automation testing solutions. This investment is driven by the need for faster deployment of digital services and the assurance of software quality. The automation testing market stands to gain from this trend, as businesses seek to leverage automation to support their digital transformation journeys.

Leave a Comment