Integration of DevOps Practices

The integration of DevOps practices within organizations significantly influences the automation testing market in North America. By fostering collaboration between development and operations teams, DevOps aims to streamline the software development lifecycle. This shift encourages the adoption of automation testing tools, which facilitate continuous integration and continuous delivery (CI/CD) processes. As of 2025, it is estimated that over 60% of organizations in North America have adopted DevOps methodologies, leading to an increased reliance on automation testing solutions. The automation testing market is likely to thrive as companies prioritize speed and efficiency in their software delivery processes, ultimately enhancing their ability to respond to market demands.

Increased Focus on Regulatory Compliance

The heightened focus on regulatory compliance is reshaping the automation testing market in North America. Industries such as finance, healthcare, and telecommunications are subject to stringent regulations that necessitate rigorous testing protocols. In 2025, the automation testing market is expected to grow by approximately 12%, driven by the need for organizations to ensure compliance with industry standards. Automation testing tools play a vital role in facilitating this process, enabling companies to conduct thorough testing and documentation. The automation testing market is thus likely to see increased investment as organizations prioritize compliance and risk management in their software development practices.

Emergence of Low-Code and No-Code Platforms

The emergence of low-code and no-code platforms is transforming the automation testing market in North America. These platforms empower users with limited technical expertise to develop applications and automate testing processes. By 2025, it is projected that the adoption of low-code solutions will increase by over 30%, driving demand for automation testing tools that can seamlessly integrate with these platforms. The automation testing market stands to benefit from this trend, as organizations seek to enhance productivity and reduce dependency on specialized development resources. This shift towards democratizing application development and testing is likely to reshape the landscape of the automation testing market.

Growing Complexity of Software Applications

The growing complexity of software applications is a critical driver for the automation testing market in North America. As applications become more intricate, traditional testing methods often fall short in ensuring comprehensive coverage and reliability. In 2025, it is anticipated that the automation testing market will expand to accommodate this complexity, with a projected value of $4.5 billion. Organizations are increasingly turning to automation testing tools to manage the challenges posed by multi-platform environments and diverse technologies. The automation testing market is thus positioned to capitalize on this trend, as businesses seek to implement effective testing strategies that can keep pace with the rapid evolution of software development.

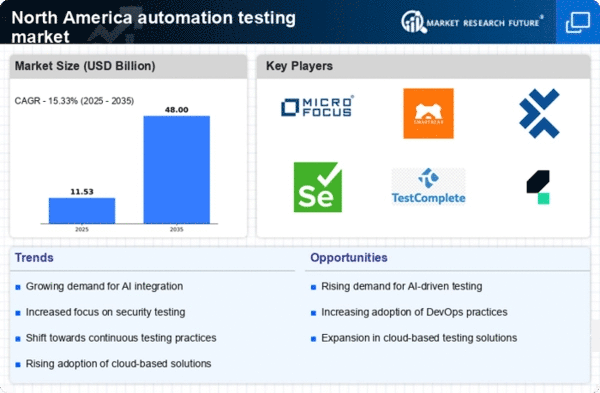

Rising Demand for Software Quality Assurance

The automation testing market in North America experiences a notable surge in demand for software quality assurance. As organizations increasingly rely on software applications, the need for robust testing solutions becomes paramount. In 2025, the market is projected to reach approximately $5 billion, reflecting a compound annual growth rate (CAGR) of around 15%. This growth is driven by the necessity for businesses to deliver high-quality products while minimizing time-to-market. Consequently, companies are investing in automation testing tools to enhance efficiency and reduce human error. The automation testing market is thus positioned to benefit from this heightened focus on quality assurance, as organizations seek to maintain competitive advantages in a rapidly evolving digital landscape.

Leave a Comment