Advancements in 5G Technology

The rollout of 5G technology across Europe is a pivotal driver for the autonomous networks market. With its promise of ultra-low latency and high-speed connectivity, 5G enables more sophisticated autonomous network solutions. This technological advancement facilitates the deployment of Internet of Things (IoT) devices, which require seamless communication and real-time data processing. As of November 2025, it is estimated that 5G networks will cover over 80% of urban areas in Europe, creating a fertile ground for the growth of autonomous networks. The integration of 5G with autonomous solutions is likely to enhance operational capabilities, thereby attracting investments in the market.

Increased Cybersecurity Concerns

The autonomous networks market in Europe is significantly influenced by the rising concerns surrounding cybersecurity. As networks become more autonomous, the potential vulnerabilities also increase, prompting organizations to invest in robust security measures. The European Union has recognized this challenge, implementing regulations that mandate higher security standards for network operations. In 2025, it is projected that cybersecurity spending in the telecommunications sector will exceed €10 billion, reflecting a growing commitment to safeguarding autonomous networks. This heightened focus on security is likely to drive innovation and investment within the autonomous networks market.

Shift Towards Cloud-Based Solutions

The transition to cloud-based solutions is reshaping the landscape of the autonomous networks market in Europe. Organizations are increasingly adopting cloud technologies to enhance flexibility, scalability, and cost-effectiveness. This shift allows for the deployment of autonomous network solutions that can be managed remotely, reducing the need for on-premises infrastructure. As of November 2025, it is estimated that over 60% of enterprises in Europe have migrated to cloud services, creating a substantial opportunity for the autonomous networks market. The integration of cloud capabilities with autonomous networks is expected to streamline operations and improve service delivery.

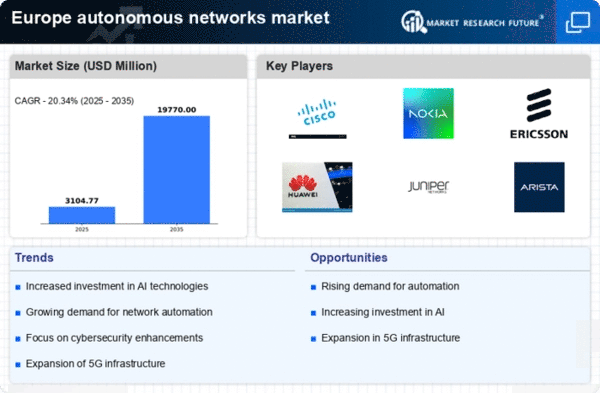

Rising Demand for Network Automation

The autonomous networks market in Europe experiences a notable surge in demand for network automation solutions. Organizations are increasingly recognizing the need for streamlined operations and enhanced efficiency. This trend is driven by the growing complexity of network infrastructures, which necessitates automated management to reduce human error and operational costs. According to recent estimates, the market for network automation in Europe is projected to reach €5 billion by 2026, reflecting a compound annual growth rate (CAGR) of approximately 15%. As businesses strive to optimize their network performance, the autonomous networks market is poised to benefit significantly from this rising demand.

Growing Focus on Operational Efficiency

The autonomous networks market is propelled by a growing emphasis on operational efficiency among European enterprises. Companies are under constant pressure to optimize their resources and reduce operational costs. Autonomous networks offer solutions that enhance efficiency through automation, predictive analytics, and real-time monitoring. As organizations seek to improve their bottom line, the adoption of autonomous network technologies is likely to increase. Recent studies indicate that businesses implementing these solutions can achieve up to a 30% reduction in operational costs, further driving the growth of the autonomous networks market in Europe.