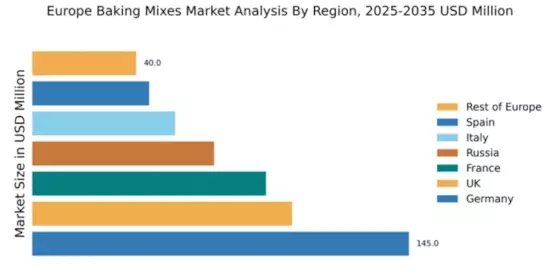

Germany : Strong Demand and Innovation Drive Growth

Key markets include major cities like Berlin, Munich, and Hamburg, where consumer demand for premium baking mixes is particularly high. The competitive landscape features strong players such as Dr. Oetker and Bahlsen, alongside international brands like Betty Crocker and Pillsbury. Local dynamics favor innovation, with a growing emphasis on organic and gluten-free products. The baking mixes sector is closely tied to the broader food industry, including retail and e-commerce channels.

UK : Home Baking Culture Fuels Demand

Key markets include London, Manchester, and Birmingham, where urban consumers are increasingly seeking convenient baking solutions. The competitive landscape features both local brands and international players like General Mills and Duncan Hines. The market is characterized by a diverse range of products, including ready-to-use mixes and specialty items. The business environment is favorable, with a growing trend towards online shopping enhancing market accessibility.

France : Culinary Tradition Meets Convenience

Key markets include Paris, Lyon, and Marseille, where demand for high-quality baking mixes is on the rise. The competitive landscape features local brands like Francine and international giants such as Pillsbury. The market dynamics are influenced by a strong emphasis on artisanal products and organic ingredients. The baking mixes sector is integrated into the broader food industry, with significant retail and online sales channels.

Russia : Growing Interest in Home Baking

Key markets include Moscow and St. Petersburg, where urban consumers are increasingly adopting baking mixes. The competitive landscape features local brands alongside international players like Betty Crocker. Local market dynamics are characterized by a preference for affordable products, while premium segments are also emerging. The baking mixes sector is closely linked to the broader food industry, including retail and e-commerce platforms.

Italy : Tradition Meets Modern Convenience

Key markets include Milan, Rome, and Naples, where demand for high-quality baking mixes is increasing. The competitive landscape features local brands like Paneangeli and international players such as Duncan Hines. The market dynamics are influenced by a strong emphasis on traditional recipes and premium ingredients. The baking mixes sector is integrated into the broader food industry, with significant retail and online sales channels.

Spain : Cultural Shift Towards Home Baking

Key markets include Madrid and Barcelona, where urban consumers are increasingly seeking convenient baking solutions. The competitive landscape features both local brands and international players like General Mills. The market is characterized by a diverse range of products, including ready-to-use mixes and specialty items. The business environment is favorable, with a growing trend towards online shopping enhancing market accessibility.

Rest of Europe : Diverse Preferences Shape Demand

Key markets include cities across Eastern and Northern Europe, where demand for baking mixes is growing. The competitive landscape features a mix of local and international brands, with players like Bob's Red Mill gaining traction. Local market dynamics are influenced by cultural preferences and varying levels of product awareness. The baking mixes sector is integrated into the broader food industry, with significant retail and online sales channels.