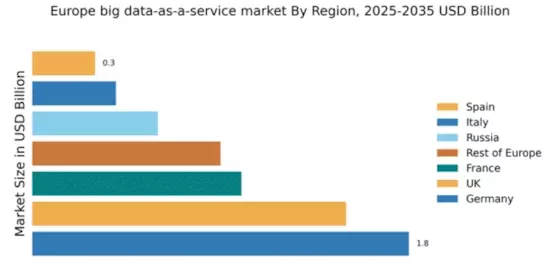

Germany : Strong Infrastructure and Innovation

Germany holds a commanding market share of 1.8 in the big data-as-a-service sector, driven by robust industrial growth and a strong emphasis on digital transformation. Key growth drivers include government initiatives promoting Industry 4.0, which encourage the adoption of data analytics across manufacturing and logistics. The demand for data-driven decision-making is rising, supported by favorable regulatory policies that enhance data privacy and security, fostering consumer trust and investment in big data solutions.

UK : Innovation and Investment at Forefront

The UK boasts a significant market share of 1.5 in the big data-as-a-service landscape, fueled by a vibrant tech ecosystem and substantial investments in AI and analytics. Demand trends indicate a growing reliance on data for business intelligence, particularly in finance and healthcare sectors. Regulatory frameworks like GDPR have shaped data handling practices, ensuring compliance while promoting innovation in data services.

France : Government Support and Growth Potential

France's market share stands at 1.0, reflecting a burgeoning interest in big data-as-a-service solutions. Key growth drivers include government-backed initiatives aimed at enhancing digital infrastructure and fostering innovation in tech startups. The demand for data analytics is particularly strong in sectors like retail and telecommunications, supported by policies that encourage data sharing and collaboration among businesses.

Russia : Regulatory Landscape and Opportunities

Russia's market share is 0.6, with growth driven by increasing digitalization across various sectors. The government is actively promoting the adoption of big data technologies, particularly in energy and telecommunications. However, regulatory challenges and data sovereignty issues pose hurdles. The demand for localized data solutions is rising, as businesses seek to comply with national data laws while leveraging analytics for operational efficiency.

Italy : Focus on Digital Transformation

Italy's market share is 0.4, with a growing emphasis on digital transformation across industries. Key growth drivers include government initiatives aimed at enhancing digital skills and infrastructure. Demand for big data services is particularly evident in manufacturing and retail sectors, where companies are increasingly leveraging data analytics for competitive advantage. However, the market is still maturing, with opportunities for growth in various sectors.

Spain : Investment in Digital Solutions

Spain holds a market share of 0.3, with a focus on enhancing digital capabilities across sectors. The government is investing in initiatives to promote data literacy and innovation, particularly in tourism and agriculture. Demand for big data-as-a-service is growing, driven by the need for data-driven insights to improve operational efficiency. The competitive landscape includes both local startups and international players, creating a dynamic market environment.

Rest of Europe : Regional Variations in Demand

The Rest of Europe accounts for a market share of 0.9, characterized by diverse market conditions and varying levels of digital maturity. Growth drivers include regional government initiatives aimed at fostering innovation and improving digital infrastructure. Demand for big data services is evident in sectors like healthcare and finance, with local players competing alongside major international firms. The business environment is influenced by regional regulations and market dynamics, creating unique opportunities for growth.