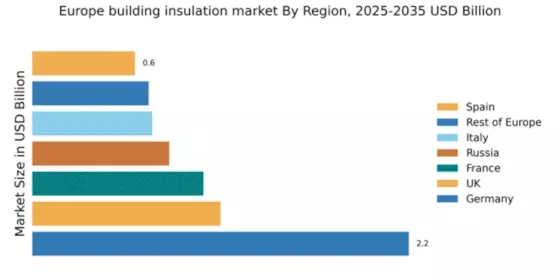

Germany : Strong Demand and Innovation Drive Growth

Germany holds a commanding market share of 2.2 in the European insulation sector, driven by robust construction activities and stringent energy efficiency regulations. The government’s commitment to reducing carbon emissions has spurred demand for high-performance insulation materials. Additionally, initiatives like the Energy Efficiency Strategy 2050 are fostering innovation in sustainable building practices, enhancing consumption patterns across residential and commercial sectors.

UK : Regulatory Changes Shape Demand Dynamics

The UK insulation market, valued at 1.1, is experiencing growth despite economic uncertainties. Key drivers include government initiatives aimed at improving energy efficiency in homes, such as the Green Homes Grant. Demand for insulation materials is also influenced by rising energy costs, prompting homeowners to invest in better thermal performance. The market is adapting to new regulations that emphasize sustainability and energy conservation.

France : Focus on Energy Efficiency Initiatives

France's insulation market, valued at 1.0, is significantly influenced by national policies promoting energy efficiency. The government’s Plan de Rénovation Énergétique encourages the use of high-quality insulation materials in residential renovations. This initiative, combined with rising awareness of environmental issues, is driving demand for innovative insulation solutions. The market is also witnessing a shift towards eco-friendly materials, aligning with EU sustainability goals.

Russia : Infrastructure Growth Fuels Demand

Russia's insulation market, valued at 0.8, is on the rise, driven by increased infrastructure development and urbanization. Government investments in housing and public infrastructure are key growth drivers, alongside a growing awareness of energy efficiency. The demand for insulation materials is expected to rise as construction projects expand in major cities like Moscow and St. Petersburg, where energy conservation is becoming a priority.

Italy : Insulation Demand on the Rise

Italy's insulation market, valued at 0.7, is benefiting from a revitalized construction sector. Government incentives for energy-efficient renovations are driving demand for insulation materials, particularly in urban areas like Milan and Rome. The market is characterized by a competitive landscape with local and international players, focusing on innovative solutions to meet regulatory standards. The emphasis on sustainability is reshaping consumption patterns in the industry.

Spain : Market Shifts Towards Sustainability

Spain's insulation market, valued at 0.6, is witnessing a shift towards sustainable building practices. Government initiatives aimed at improving energy efficiency in buildings are driving demand for insulation materials. The market is characterized by increasing consumer awareness regarding energy costs and environmental impact, particularly in regions like Catalonia and Madrid. Local manufacturers are adapting to these trends by offering eco-friendly insulation solutions.

Rest of Europe : Varied Demand Across Regions

The Rest of Europe, with a market value of 0.68, presents diverse opportunities in the insulation sector. Different countries exhibit varying demand trends influenced by local regulations and economic conditions. For instance, Nordic countries emphasize thermal performance due to harsh climates, while Southern Europe focuses on energy efficiency. The competitive landscape includes both local and international players, adapting to regional market dynamics and consumer preferences.