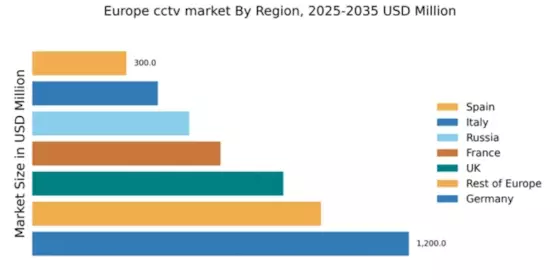

Germany : Strong Demand and Innovation Drive Growth

Germany holds a dominant position in the European CCTV market, accounting for 30% of the total market share with a value of $1,200.0 million. Key growth drivers include increasing security concerns, advancements in technology, and government initiatives promoting smart city projects. The demand for high-definition cameras and integrated security solutions is on the rise, supported by regulatory policies that emphasize public safety and surveillance. Infrastructure development, particularly in urban areas, further fuels market expansion.

UK : Technological Advancements Shape Market Trends

The UK CCTV market is valued at $800.0 million, representing 20% of the European market. Growth is driven by rising crime rates and the increasing adoption of smart technologies. The demand for cloud-based surveillance systems is growing, alongside government initiatives aimed at improving public safety. Regulatory frameworks are evolving to address privacy concerns while promoting security solutions, creating a balanced environment for market growth.

France : Focus on Quality and Compliance

France's CCTV market is valued at $600.0 million, capturing 15% of the European market. The growth is fueled by heightened security measures in public spaces and commercial establishments. Demand for high-quality imaging and compliance with GDPR regulations are key trends. Government initiatives to enhance urban security and infrastructure development in cities like Paris and Lyon are pivotal in shaping the market landscape, driving investments in advanced surveillance technologies.

Russia : Government Initiatives Boost Growth

The Russian CCTV market is valued at $500.0 million, accounting for 12.5% of the European market. Key growth drivers include government initiatives aimed at enhancing national security and urban safety. The demand for surveillance systems is increasing in major cities like Moscow and St. Petersburg, where infrastructure projects are underway. The competitive landscape features both local and international players, with a focus on cost-effective solutions tailored to specific market needs.

Italy : Focus on Urban Safety Initiatives

Italy's CCTV market is valued at $400.0 million, representing 10% of the European market. The growth is driven by increasing security concerns in urban areas and government initiatives promoting public safety. Demand for integrated security systems is rising, particularly in cities like Rome and Milan. The competitive landscape includes established players and local firms, with a focus on innovative solutions that meet regulatory standards and consumer expectations.

Spain : Security Needs Drive Technological Adoption

Spain's CCTV market is valued at $300.0 million, capturing 7.5% of the European market. The growth is driven by rising security needs in both public and private sectors. Demand for advanced surveillance technologies is increasing, supported by government initiatives aimed at enhancing public safety. Key cities like Madrid and Barcelona are focal points for market activity, with a competitive landscape featuring both domestic and international players offering tailored solutions.

Rest of Europe : Varied Demand Across Sub-regions

The Rest of Europe CCTV Market is valued at $920.0 million, accounting for 22.5% of the total market. Growth is driven by varying security needs across different countries, influenced by local regulations and economic conditions. Demand for surveillance solutions is increasing in both urban and rural areas, with a focus on compliance with EU regulations. The competitive landscape is diverse, featuring a mix of local and international players catering to specific market demands.