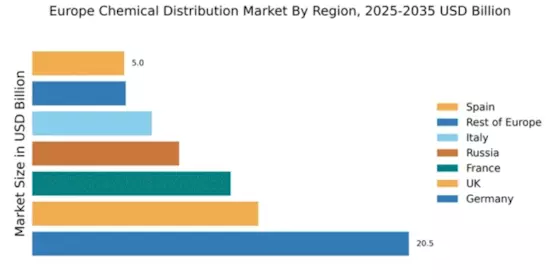

Germany : Strong Growth and Innovation Hub

Germany holds a commanding 20.5% market share in the European chemical distribution sector, valued at approximately €50 billion. Key growth drivers include robust industrial output, a strong automotive sector, and increasing demand for sustainable chemicals. Regulatory policies favoring green technologies and significant government initiatives to promote innovation further enhance market dynamics. The country’s advanced infrastructure supports efficient logistics and distribution, making it a prime location for chemical companies.

UK : Navigating Post-Brexit Dynamics

Key markets include London, Manchester, and Birmingham, where a mix of multinational and local players operate. Major companies like BASF and Univar Solutions have a significant presence, contributing to a competitive landscape. The business environment is characterized by innovation in sectors such as healthcare and automotive, with increasing investments in R&D to meet changing consumer demands.

France : Innovation and Sustainability Focus

Key markets include Paris, Lyon, and Marseille, where major players like Solvay and Dow operate. The competitive landscape features a mix of global and local firms, fostering innovation and collaboration. The business environment is dynamic, with a focus on high-value applications in sectors such as cosmetics and food additives, driving growth and investment.

Russia : Growth Amid Economic Challenges

Key markets include Moscow and St. Petersburg, where major players like SABIC and LyondellBasell are establishing a foothold. The competitive landscape is characterized by a mix of state-owned and private enterprises, navigating a complex business environment. The chemical sector is vital for agriculture and construction, with significant investments aimed at modernizing production facilities.

Italy : Focus on Specialty Chemicals

Key markets include Milan, Turin, and Bologna, where major players like Mitsubishi Chemical and Huntsman Corporation are active. The competitive landscape features a blend of established firms and innovative startups, fostering a dynamic business environment. The chemical sector plays a crucial role in textiles and automotive applications, driving investment and development.

Spain : Strategic Location for Distribution

Key markets include Barcelona and Madrid, where major players like Eastman Chemical and Univar Solutions are establishing operations. The competitive landscape is characterized by a mix of local and international firms, creating a vibrant business environment. The chemical sector is essential for construction and agriculture, with ongoing investments in innovation and sustainability.

Rest of Europe : Varied Growth Across Regions

Key markets include countries like Belgium, Netherlands, and Switzerland, where major players like Solvay and BASF have a presence. The competitive landscape is diverse, with a mix of local and multinational firms operating in various sectors. The chemical industry plays a vital role in pharmaceuticals, agriculture, and manufacturing, driving investment and development across the region.