Adoption of Cloud Services

The rapid adoption of cloud services across various sectors in Europe is significantly influencing the cloud encryption market. As organizations migrate their operations to the cloud, the need for effective encryption solutions becomes paramount to protect data stored in these environments. According to recent estimates, the cloud services market in Europe is expected to reach €100 billion by 2026, with a substantial portion of this growth attributed to the increasing reliance on cloud-based applications. Consequently, the demand for cloud encryption solutions is likely to rise in tandem, as businesses prioritize data security in their cloud strategies. This trend indicates a strong correlation between cloud service adoption and the growth of the cloud encryption market, suggesting that as more companies transition to the cloud, the need for encryption will continue to escalate.

Rising Data Privacy Concerns

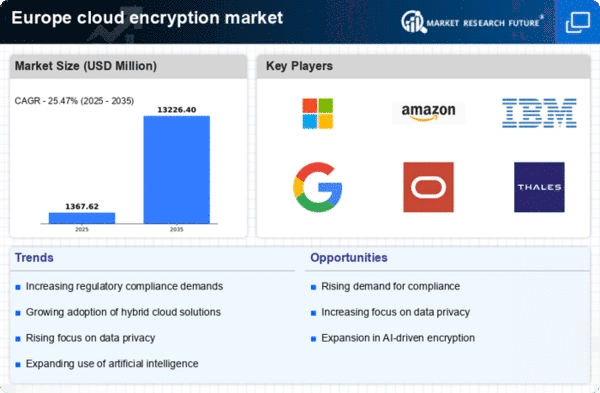

Increasing awareness of data privacy issues among consumers and businesses in Europe is driving the cloud encryption market. With regulations such as the General Data Protection Regulation (GDPR) mandating strict data protection measures, organizations are compelled to adopt encryption solutions to safeguard sensitive information. This regulatory landscape has led to a surge in demand for cloud encryption services, as companies seek to ensure compliance and protect customer data. In 2025, the cloud encryption market in Europe is projected to grow by approximately 20%, reflecting the urgency for businesses to implement robust encryption strategies. As data breaches become more prevalent, the emphasis on encryption as a fundamental security measure is likely to intensify, further propelling market growth.

Increased Cybersecurity Threats

The rise in cybersecurity threats across Europe is a significant driver of the cloud encryption market. With cyberattacks becoming more sophisticated and frequent, organizations are increasingly recognizing the necessity of implementing robust encryption measures to protect their data. Reports indicate that cybercrime costs European businesses over €200 billion annually, underscoring the urgency for effective security solutions. As a result, the cloud encryption market is likely to experience substantial growth as companies invest in encryption technologies to mitigate risks associated with data breaches and cyberattacks. This heightened focus on cybersecurity is expected to propel the adoption of cloud encryption solutions, as organizations strive to enhance their overall security posture in an increasingly hostile digital environment.

Growing Demand for Remote Work Solutions

The shift towards remote work in Europe has created a heightened demand for secure cloud solutions, thereby impacting the cloud encryption market. As organizations adapt to flexible work arrangements, the need to protect sensitive data accessed remotely has become critical. This trend has led to an increased focus on encryption technologies that secure data in transit and at rest. In 2025, it is anticipated that the cloud encryption market will expand as businesses seek to implement comprehensive security measures that facilitate remote work while ensuring data protection. The convergence of remote work and cloud encryption solutions suggests a growing recognition of the importance of safeguarding information in a distributed work environment, further driving market growth.

Technological Advancements in Encryption

Technological advancements in encryption methodologies are playing a crucial role in shaping the cloud encryption market in Europe. Innovations such as homomorphic encryption and quantum-resistant algorithms are emerging, providing enhanced security features that address the evolving threat landscape. These advancements not only improve the effectiveness of encryption solutions but also increase their appeal to organizations seeking to protect sensitive data. As businesses become more aware of the potential vulnerabilities associated with traditional encryption methods, the demand for cutting-edge solutions is likely to grow. In 2025, the cloud encryption market is expected to witness a shift towards these advanced technologies, indicating a trend where organizations prioritize innovative encryption solutions to stay ahead of cyber threats.