Germany : Strong Infrastructure and Innovation Hub

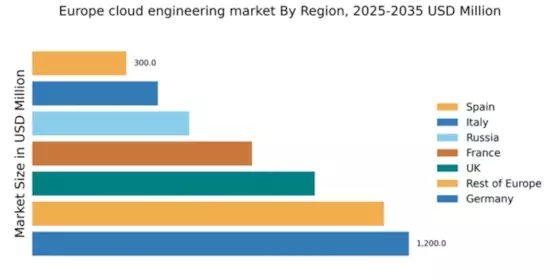

Germany holds a dominant position in the European cloud engineering market, with a market value of $1200.0 million, representing approximately 25% of the total market share. Key growth drivers include a robust industrial base, increasing digital transformation initiatives, and supportive government policies promoting cloud adoption. The demand for cloud services is driven by sectors such as automotive, manufacturing, and finance, with significant investments in data centers and cybersecurity measures enhancing infrastructure.

UK : Innovation and Financial Services Powerhouse

The UK cloud engineering market is valued at $900.0 million, accounting for about 19% of the European market. Growth is fueled by the rapid adoption of cloud solutions in financial services, healthcare, and retail sectors. Government initiatives, such as the Digital Strategy, encourage innovation and investment in cloud technologies. The demand for hybrid cloud solutions is rising, reflecting a shift towards flexible IT infrastructures.

France : Strong Demand in Tech and Retail

France's cloud engineering market is valued at $700.0 million, representing roughly 15% of the European market. Key growth drivers include a surge in e-commerce and digital services, alongside government support for tech startups. The French government has launched initiatives to enhance digital infrastructure, promoting cloud adoption across various sectors. The demand for SaaS and PaaS solutions is particularly strong, reflecting changing consumption patterns.

Russia : Expanding Market with Unique Challenges

Russia's cloud engineering market is valued at $500.0 million, making up about 10% of the European market. Growth is driven by increasing digitalization across industries, particularly in telecommunications and finance. However, regulatory challenges and geopolitical factors impact market dynamics. The Russian government is promoting local cloud solutions to enhance data sovereignty, influencing consumption patterns and demand trends.

Italy : Focus on Digital Transformation Initiatives

Italy's cloud engineering market is valued at $400.0 million, representing approximately 8% of the European market. Key growth drivers include a focus on digital transformation across sectors such as manufacturing and public services. Government initiatives, like the National Plan for Digital Transformation, are fostering cloud adoption. The demand for cloud-based solutions is increasing, particularly in small and medium enterprises (SMEs).

Spain : Digital Growth in Key Sectors

Spain's cloud engineering market is valued at $300.0 million, accounting for about 6% of the European market. Growth is driven by increasing investments in digital infrastructure and a rising demand for cloud services in sectors like tourism and finance. The Spanish government is implementing policies to support digitalization, enhancing the business environment for cloud providers. The competitive landscape includes both local and international players.

Rest of Europe : Varied Growth Across Multiple Nations

The Rest of Europe cloud engineering market is valued at $1120.0 million, representing about 23% of the total market. This sub-region includes diverse markets with varying growth rates, driven by local demand for cloud services in sectors such as healthcare, education, and manufacturing. Government initiatives across different countries are promoting cloud adoption, while infrastructure development is uneven. The competitive landscape features both established players and emerging local providers.

Leave a Comment