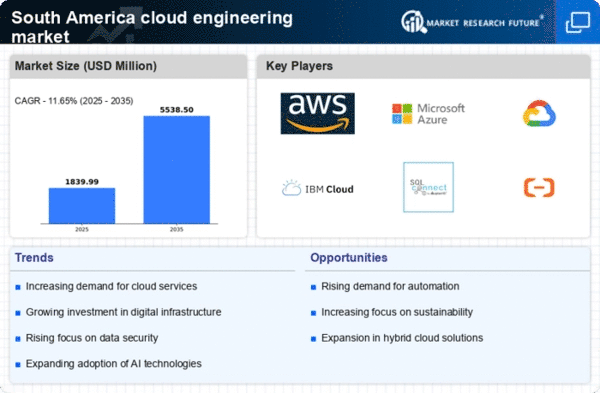

The cloud engineering market in South America is characterized by a dynamic competitive landscape, driven by rapid digital transformation and increasing demand for scalable solutions. Major players such as Amazon Web Services (US), Microsoft Azure (US), and Google Cloud (US) are at the forefront, leveraging their extensive resources and technological expertise to capture market share. These companies focus on innovation and regional expansion, with strategies that include enhancing service offerings and establishing local data centers to improve latency and compliance with regional regulations. Their collective efforts contribute to a competitive environment that is increasingly concentrated, with a few key players dominating the market while also fostering a degree of fragmentation through smaller, niche providers.

Key business tactics employed by these companies include localizing services and optimizing supply chains to better serve the diverse needs of South American customers. The market structure appears moderately fragmented, with a mix of large multinational corporations and emerging local players. This structure allows for a variety of service offerings, catering to different segments of the market, from enterprise solutions to small and medium-sized enterprises (SMEs). The influence of key players is substantial, as they set benchmarks for service quality and innovation, compelling smaller firms to adapt and evolve.

In October 2025, Amazon Web Services (US) announced the opening of a new data center in São Paulo, Brazil, aimed at enhancing its cloud service capabilities in the region. This strategic move is significant as it not only strengthens AWS's infrastructure but also aligns with the growing demand for cloud services among Brazilian enterprises. By investing in local infrastructure, AWS is likely to improve service delivery and compliance with local regulations, thereby solidifying its market position.

In September 2025, Microsoft Azure (US) launched a new initiative focused on sustainability, committing to achieve carbon negativity by 2030. This initiative is particularly relevant in South America, where environmental concerns are paramount. By prioritizing sustainability, Microsoft Azure not only addresses regulatory pressures but also appeals to environmentally conscious consumers and businesses, potentially enhancing its competitive edge in the region.

In August 2025, Google Cloud (US) expanded its partnership with local telecommunications providers to enhance connectivity and service delivery across South America. This strategic alliance is crucial as it allows Google Cloud to leverage existing infrastructure, thereby reducing costs and improving service reliability. Such partnerships are indicative of a broader trend where cloud providers seek to integrate more deeply with local ecosystems to enhance their service offerings.

As of November 2025, the competitive trends in the cloud engineering market are increasingly defined by digitalization, sustainability, and the integration of artificial intelligence (AI). Strategic alliances are becoming more prevalent, as companies recognize the value of collaboration in enhancing service delivery and innovation. Looking ahead, competitive differentiation is likely to evolve from traditional price-based competition to a focus on technological innovation, reliability, and sustainability. This shift suggests that companies that can effectively leverage these trends will be better positioned to thrive in the increasingly competitive landscape.

Leave a Comment