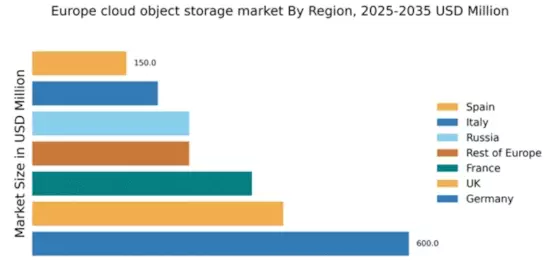

Germany : Strong Infrastructure and Innovation Hub

Germany holds a dominant position in the European cloud object-storage market, accounting for 30% of the total market share with a value of $600.0 million. Key growth drivers include the increasing demand for data storage solutions, driven by digital transformation across industries. Regulatory policies, such as the GDPR, promote data protection, while government initiatives support cloud adoption. The robust infrastructure, including advanced data centers, further fuels market growth.

UK : Innovation and Regulatory Support

The UK cloud object-storage market is valued at $400.0 million, representing 20% of the European market. Growth is driven by the rapid digitalization of businesses and increasing reliance on cloud solutions for data management. The UK government actively supports cloud initiatives through funding and regulatory frameworks, enhancing market confidence. The demand for scalable storage solutions is evident in various sectors, including finance and healthcare.

France : Strong Demand in Diverse Sectors

France's cloud object-storage market is valued at $350.0 million, capturing 17.5% of the European market. The growth is propelled by the increasing adoption of cloud services across sectors like retail and manufacturing. Government initiatives, such as the France 2030 plan, aim to boost digital infrastructure and innovation. The demand for secure and compliant storage solutions is rising, influenced by local regulations and consumer preferences.

Russia : Strategic Market Developments

Russia's cloud object-storage market is valued at $250.0 million, accounting for 12.5% of the European market. Key growth drivers include significant investments in IT infrastructure and a push for digital transformation across various industries. Government policies favor local cloud solutions, enhancing market dynamics. The demand for cloud services is particularly strong in sectors like telecommunications and e-commerce, reflecting changing consumption patterns.

Italy : Focus on Digital Transformation

Italy's cloud object-storage market is valued at $200.0 million, representing 10% of the European market. The growth is driven by increasing digitalization efforts across industries, particularly in manufacturing and retail. Government initiatives, such as the Digital Italy program, support cloud adoption and infrastructure development. The demand for flexible and scalable storage solutions is evident, reflecting changing business needs and consumer behavior.

Spain : Investment in Digital Infrastructure

Spain's cloud object-storage market is valued at $150.0 million, capturing 7.5% of the European market. The growth is fueled by rising investments in digital infrastructure and cloud services across various sectors, including tourism and finance. Government policies encourage innovation and cloud adoption, enhancing the business environment. The demand for secure and efficient storage solutions is increasing, driven by local market dynamics and consumer preferences.

Rest of Europe : Varied Growth Across Regions

The Rest of Europe accounts for a combined market value of $250.0 million, representing 12.5% of the overall market. Growth drivers vary by country, with increasing digitalization and cloud adoption across sectors. Regulatory frameworks and government initiatives play a crucial role in shaping market dynamics. The demand for cloud solutions is evident in industries such as healthcare and education, reflecting diverse consumption patterns across the region.