Rising Demand for Scalability

The The cloud system management market in Europe is experiencing a notable surge in demand for scalable solutions. Organizations are increasingly seeking systems that can adapt to fluctuating workloads and business growth. This trend is driven by the need for flexibility in resource allocation, allowing companies to optimize costs while maintaining performance. According to recent data, approximately 70% of European enterprises prioritize scalability in their cloud strategies. As businesses expand, the ability to scale resources up or down becomes crucial, thereby propelling the growth of the cloud system-management market. Furthermore, the integration of scalable cloud solutions enables organizations to respond swiftly to market changes, enhancing their competitive edge. This rising demand for scalability is likely to continue influencing the cloud system-management market in Europe, as companies strive to remain agile in an ever-evolving business landscape.

Increased Focus on Cost Efficiency

Cost efficiency remains a pivotal driver in the cloud system-management market in Europe. Organizations are increasingly adopting cloud solutions to reduce operational expenses associated with traditional IT infrastructure. By leveraging cloud technologies, companies can minimize capital expenditures and optimize their IT budgets. Recent studies indicate that businesses can save up to 30% on IT costs by migrating to cloud-based systems. This financial incentive encourages enterprises to explore various cloud management options, leading to a more competitive landscape. Additionally, the potential for pay-as-you-go pricing models allows organizations to align their spending with actual usage, further enhancing cost efficiency. As a result, the emphasis on cost reduction is likely to continue shaping the cloud system-management market in Europe, driving innovation and adoption of more efficient solutions.

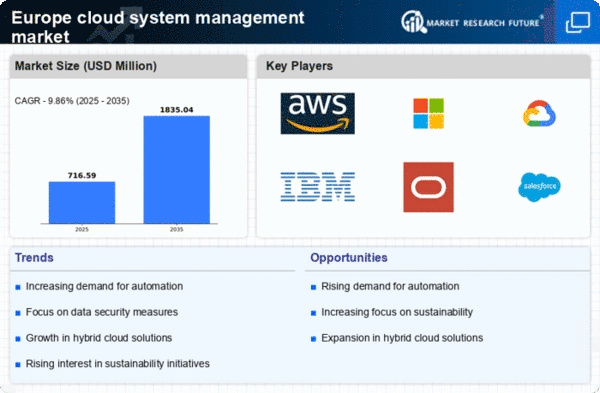

Emergence of Hybrid Cloud Solutions

The emergence of hybrid cloud solutions is reshaping the cloud system-management market in Europe. Organizations are increasingly adopting hybrid models that combine public and private cloud environments, allowing for greater flexibility and control over their data. This trend is driven by the need for businesses to balance the benefits of public cloud scalability with the security and compliance advantages of private clouds. Recent data suggests that approximately 55% of European enterprises are exploring hybrid cloud strategies to optimize their IT infrastructure. The ability to seamlessly integrate various cloud environments enhances operational efficiency and enables organizations to tailor their cloud solutions to specific business needs. As hybrid cloud adoption continues to rise, it is expected to significantly impact the cloud system-management market in Europe, fostering innovation and collaboration among service providers.

Growing Regulatory Compliance Requirements

The The cloud system management market in Europe is significantly influenced by the increasing regulatory compliance requirements imposed on businesses. Organizations must navigate a complex landscape of data protection laws, such as the General Data Protection Regulation (GDPR), which mandates stringent data handling practices. Compliance with these regulations necessitates robust cloud management solutions that ensure data security and privacy. As a result, companies are investing in cloud systems that offer comprehensive compliance features, thereby driving growth in the market. It is estimated that around 60% of European businesses prioritize compliance when selecting cloud service providers. This focus on regulatory adherence not only enhances trust among customers but also mitigates the risk of costly penalties. Consequently, the growing emphasis on compliance is likely to remain a key driver in the cloud system-management market in Europe, shaping the development of innovative solutions.

Advancements in Cloud Security Technologies

Advancements in cloud security technologies are becoming a crucial driver in the cloud system-management market in Europe. As organizations increasingly migrate sensitive data to the cloud, the demand for robust security measures intensifies. Innovative security solutions, such as advanced encryption techniques and AI-driven threat detection, are being developed to address these concerns. Recent reports indicate that nearly 75% of European businesses consider security a top priority when selecting cloud service providers. This heightened focus on security not only protects sensitive information but also builds customer trust, which is essential for market growth. Furthermore, as cyber threats evolve, continuous advancements in security technologies are likely to shape the cloud system-management market in Europe, ensuring that organizations can safeguard their data effectively.

Leave a Comment