Rising Demand for Scalability

The cloud system-management market. experiences a notable surge in demand for scalable solutions. Organizations are increasingly seeking systems that can adapt to fluctuating workloads and business growth. This trend is driven by the need for flexibility in resource allocation, allowing companies to optimize costs while maintaining performance. According to recent data, approximately 70% of enterprises in North America prioritize scalability when selecting cloud management solutions. This focus on scalability is reshaping the cloud system-management market, as vendors are compelled to innovate and offer solutions that can seamlessly scale up or down based on user requirements.

Shift Towards Cost Efficiency

Cost efficiency remains a critical driver in the cloud system-management market in North America. Organizations are continuously seeking ways to reduce operational expenses while maximizing the value derived from their cloud investments. This trend is evident as companies increasingly adopt pay-as-you-go pricing models, which allow for better budget management and resource allocation. Recent studies indicate that nearly 60% of North American businesses prioritize cost-effective solutions when selecting cloud management services. As a result, vendors are focusing on developing tools that enhance visibility into resource usage and optimize spending, thereby driving growth in the cloud system-management market.

Growing Focus on Data Governance

Data governance is becoming an essential consideration in the cloud system-management market in North America. With the increasing volume of data generated, organizations are recognizing the importance of establishing robust governance frameworks to ensure data integrity, security, and compliance. This focus is particularly relevant in industries such as finance and healthcare, where regulatory requirements are stringent. As a result, the market is witnessing a shift towards solutions that offer comprehensive data management capabilities. Approximately 65% of organizations in North America are investing in cloud management tools that emphasize data governance, indicating a strong trend towards responsible data handling.

Emergence of Multi-Cloud Strategies

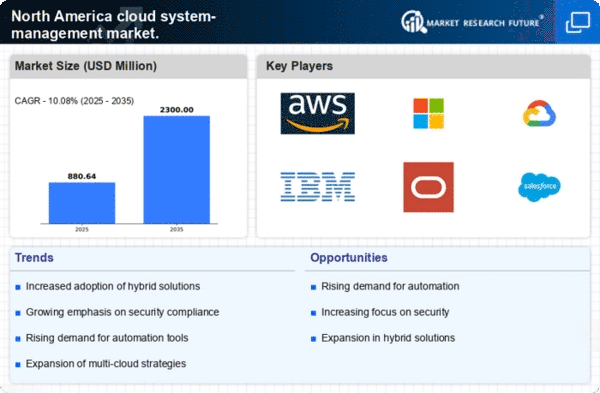

The adoption of multi-cloud strategies is reshaping the cloud system-management market in North America. Organizations are increasingly leveraging multiple cloud service providers to enhance flexibility, avoid vendor lock-in, and optimize performance. This trend is driven by the desire to utilize the best services from various providers while ensuring redundancy and resilience. Recent surveys reveal that over 50% of North American enterprises are implementing multi-cloud approaches, which necessitate sophisticated management tools to oversee diverse environments. Consequently, the cloud system-management market is evolving to accommodate the complexities associated with multi-cloud deployments, prompting vendors to innovate and offer integrated solutions.

Integration of AI and Machine Learning

The integration of artificial intelligence (AI) and machine learning (ML) technologies is transforming the cloud system-management market.. These advanced technologies enable organizations to automate routine tasks, enhance decision-making processes, and improve operational efficiency. As businesses increasingly adopt AI-driven solutions, the market is projected to grow significantly, with estimates suggesting a compound annual growth rate (CAGR) of 25% over the next five years. This integration not only streamlines management processes but also provides predictive analytics, allowing organizations to proactively address potential issues before they escalate.

Leave a Comment