Investment in Digital Transformation

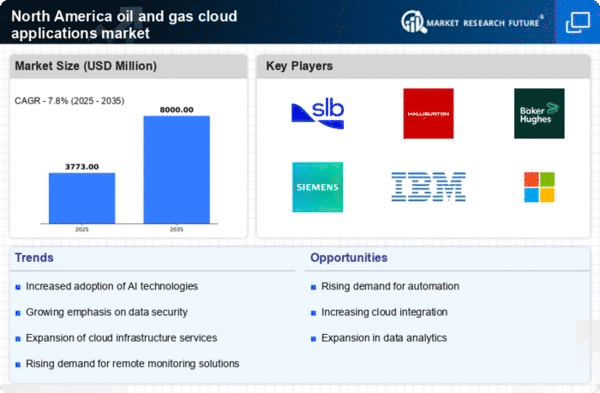

Digital transformation is a key driver in the oil gas-cloud-applications market, particularly in North America. Companies are increasingly investing in cloud technologies to modernize their operations and enhance their digital capabilities. This shift is largely influenced by the need to adapt to changing market dynamics and consumer expectations. Recent statistics indicate that over 60% of oil and gas companies in North America have initiated digital transformation projects, with cloud applications being a central component. These investments not only improve operational efficiency but also facilitate better data management and analytics. As organizations continue to prioritize digital transformation, the oil gas-cloud-applications market is expected to witness substantial growth, driven by the adoption of innovative technologies that enhance overall performance.

Enhanced Data Security and Compliance

Data security and compliance are paramount concerns in the oil gas-cloud-applications market. As companies increasingly migrate to cloud solutions, the need for robust security measures becomes critical. In North America, regulatory requirements necessitate stringent data protection protocols, which cloud applications can effectively address. The market is witnessing a surge in demand for cloud services that offer advanced security features, such as encryption and multi-factor authentication. According to industry reports, approximately 70% of oil and gas firms prioritize data security when selecting cloud providers. This focus on enhanced security and compliance not only mitigates risks but also fosters trust among stakeholders, thereby driving growth in the oil gas-cloud-applications market.

Growing Importance of Remote Monitoring

Remote monitoring capabilities are becoming increasingly vital in the oil gas-cloud-applications market. The ability to monitor operations in real-time from remote locations enhances operational efficiency and safety. In North America, companies are leveraging cloud applications to implement remote monitoring solutions that provide valuable insights into equipment performance and environmental conditions. This trend is particularly relevant in the context of asset management and maintenance, where timely interventions can prevent costly downtimes. Recent data suggests that organizations utilizing remote monitoring technologies can reduce maintenance costs by up to 25%. As the demand for such solutions continues to rise, the oil gas-cloud-applications market is likely to expand, driven by the need for enhanced operational oversight.

Rising Demand for Operational Efficiency

The oil gas-cloud-applications market is experiencing a notable shift towards operational efficiency. Companies are increasingly adopting cloud-based solutions to streamline their operations, reduce costs, and enhance productivity. In North America, the demand for such solutions is driven by the need to optimize resource management and improve decision-making processes. According to recent data, organizations that implement cloud applications can achieve operational cost reductions of up to 30%. This trend is likely to continue as firms seek to leverage technology to gain a competitive edge. Furthermore, the integration of cloud applications allows for real-time data access, which is crucial for timely decision-making in the oil and gas sector. As a result, the focus on operational efficiency is a significant driver in the oil gas-cloud-applications market.

Collaboration and Partnership Opportunities

Collaboration and partnership opportunities are emerging as a significant driver in the oil gas-cloud-applications market. Companies are increasingly recognizing the value of strategic alliances to enhance their technological capabilities and expand their service offerings. In North America, partnerships between cloud service providers and oil and gas companies are becoming more common, facilitating the development of tailored solutions that meet specific industry needs. This collaborative approach not only accelerates innovation but also enables firms to share resources and expertise. Recent trends indicate that partnerships can lead to cost savings of up to 20% in project implementation. As organizations seek to leverage collective strengths, the oil gas-cloud-applications market is poised for growth through enhanced collaboration.

Leave a Comment