Enhanced Data Analytics Capabilities

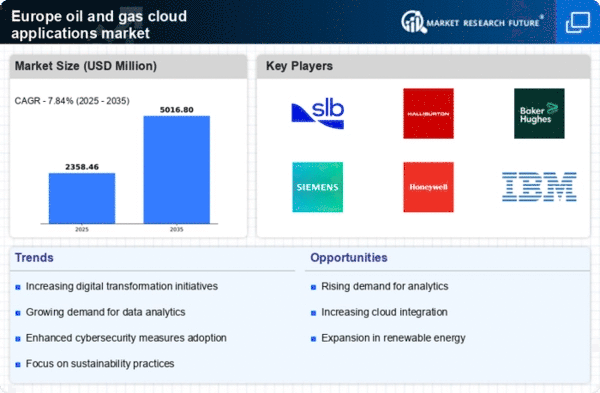

The oil gas-cloud-applications market is significantly influenced by the enhanced data analytics capabilities offered by cloud technologies. Companies are increasingly leveraging cloud-based analytics to gain insights from vast amounts of data generated in their operations. This trend is particularly relevant in Europe, where the oil and gas sector is expected to generate over 2 exabytes of data annually by 2025. Cloud applications facilitate advanced analytics, enabling organizations to make data-driven decisions that improve efficiency and reduce operational risks. As the demand for actionable insights grows, the integration of sophisticated analytics tools within cloud platforms is likely to become a key driver in the oil gas-cloud-applications market.

Shift Towards Digital Transformation

The oil gas-cloud-applications market is witnessing a significant shift towards digital transformation, driven by the need for innovation and modernization. Companies are increasingly recognizing the importance of digital tools in enhancing operational capabilities and customer engagement. The European oil and gas sector is projected to invest approximately €10 billion in digital technologies by 2026, reflecting a commitment to adopting cloud applications. This transformation is not merely about technology; it encompasses a cultural shift within organizations, fostering agility and responsiveness. As businesses embrace digital solutions, the oil gas-cloud-applications market is likely to expand, with cloud technologies playing a pivotal role in this evolution.

Rising Demand for Operational Efficiency

The oil gas-cloud-applications market in Europe is experiencing a notable surge in demand for operational efficiency. Companies are increasingly adopting cloud-based solutions to streamline their operations, reduce costs, and enhance productivity. According to recent data, organizations that implement cloud applications can achieve operational cost reductions of up to 30%. This trend is driven by the need to optimize resource management and improve decision-making processes. As the industry faces mounting pressure to enhance efficiency, the integration of cloud technologies becomes essential. Furthermore, the ability to access real-time data and analytics through cloud platforms allows companies to respond swiftly to market changes, thereby reinforcing their competitive edge in the oil gas-cloud-applications market.

Collaboration and Partnership Opportunities

Collaboration and partnership opportunities are emerging as a vital driver in the oil gas-cloud-applications market. Companies are increasingly seeking strategic alliances to enhance their technological capabilities and expand their service offerings. In Europe, partnerships between cloud service providers and oil and gas companies are becoming more common, facilitating the development of tailored solutions that address specific industry challenges. This collaborative approach not only accelerates innovation but also allows companies to share resources and expertise, potentially reducing costs by up to 15%. As the market evolves, the emphasis on collaboration is likely to strengthen, positioning partnerships as a crucial element in the growth of the oil gas-cloud-applications market.

Regulatory Compliance and Environmental Standards

In the oil gas-cloud-applications market, stringent regulatory compliance and environmental standards are becoming increasingly critical. European regulations mandate that companies adhere to specific environmental guidelines, which necessitates the adoption of cloud solutions for better data management and reporting. The European Union has set ambitious targets for reducing greenhouse gas emissions, compelling companies to invest in technologies that facilitate compliance. Cloud applications enable organizations to track emissions and manage environmental data more effectively, potentially reducing compliance costs by 20%. As regulatory frameworks evolve, the demand for cloud-based solutions that support compliance efforts is likely to grow, positioning these technologies as vital components in the oil gas-cloud-applications market.

Leave a Comment