Collaboration and Partnerships

Collaboration and partnerships are emerging as critical drivers in the oil gas-cloud-applications market in South America. Companies are increasingly forming strategic alliances with technology providers to enhance their cloud capabilities and accelerate innovation. These partnerships enable organizations to leverage specialized expertise and resources, facilitating the development of tailored cloud solutions that meet specific industry needs. For instance, collaborations between oil and gas companies and cloud service providers can lead to the creation of advanced analytics platforms that improve decision-making processes. This trend is expected to foster a more competitive landscape, as companies that embrace collaboration are likely to gain a technological advantage. Consequently, the oil gas-cloud-applications market is anticipated to expand as partnerships become more prevalent.

Focus on Data Security and Privacy

Data security and privacy concerns are increasingly shaping the oil gas-cloud-applications market in South America. As companies migrate to cloud-based solutions, the need to protect sensitive information becomes paramount. Organizations are investing in advanced security measures to safeguard their data against cyber threats and ensure compliance with privacy regulations. The implementation of robust security protocols within cloud applications is expected to enhance trust among stakeholders and facilitate wider adoption. Recent studies suggest that companies prioritizing data security can experience a 40% reduction in data breaches. This focus on security not only protects valuable assets but also positions companies favorably in a competitive market. Therefore, the oil gas-cloud-applications market is likely to grow as organizations prioritize data security in their cloud strategies.

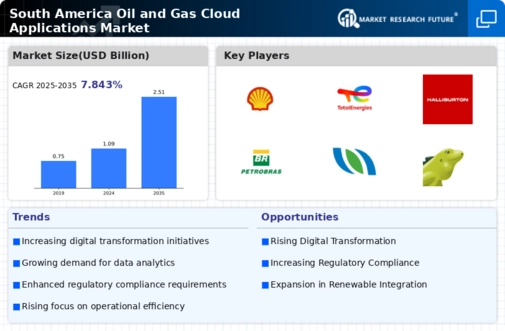

Investment in Digital Transformation

The oil gas-cloud-applications market in South America is witnessing a robust investment in digital transformation initiatives. Companies are increasingly recognizing the importance of digital technologies in enhancing their operational capabilities and competitiveness. The shift towards cloud-based solutions is a key component of this transformation, as it allows for greater flexibility and scalability. Recent reports indicate that investments in digital technologies within the oil and gas sector are projected to reach $20 billion by 2026 in South America. This influx of capital is likely to drive the adoption of cloud applications, as organizations seek to modernize their infrastructure and improve data management. As a result, the oil gas-cloud-applications market is poised for substantial growth as companies embrace digital transformation.

Rising Demand for Operational Efficiency

The oil gas-cloud-applications market in South America is experiencing a notable surge in demand for operational efficiency. Companies are increasingly adopting cloud-based solutions to streamline their operations, reduce costs, and enhance productivity. This trend is driven by the need to optimize resource management and improve decision-making processes. According to recent data, cloud applications can reduce operational costs by up to 30%, making them an attractive option for companies in the region. Furthermore, the integration of advanced technologies such as IoT and AI within cloud platforms is expected to further enhance operational capabilities. As a result, The oil and gas cloud applications market is likely to witness significant growth as organizations seek to leverage these technologies to gain a competitive edge.

Regulatory Compliance and Safety Standards

In South America, the oil gas-cloud-applications market is significantly influenced by stringent regulatory compliance and safety standards. Governments are increasingly implementing regulations that require companies to adopt advanced technologies to ensure safety and environmental protection. Cloud applications provide the necessary tools for real-time monitoring and reporting, enabling companies to comply with these regulations effectively. For instance, the adoption of cloud-based safety management systems can lead to a reduction in incidents by as much as 25%. This focus on compliance not only enhances safety but also fosters a culture of accountability within organizations. Consequently, the demand for cloud applications in the oil and gas sector is expected to rise as companies strive to meet regulatory requirements while maintaining operational efficiency.

Leave a Comment