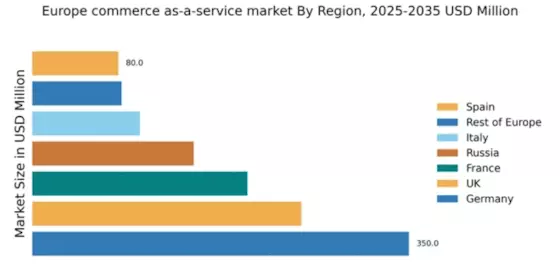

Germany : Strong Growth and Innovation Hub

Germany holds a dominant position in the European commerce as-a-service market, with a market value of $350.0 million, representing approximately 35% of the total market share. Key growth drivers include a robust e-commerce infrastructure, increasing digitalization among SMEs, and supportive government initiatives aimed at fostering innovation. Regulatory policies are favorable, promoting competition and consumer protection, while significant investments in logistics and technology enhance service delivery.

UK : Innovation and Consumer Engagement

The UK commerce as-a-service market is valued at $250.0 million, accounting for about 25% of the European market. Growth is fueled by a high adoption rate of online shopping, particularly post-pandemic, and a strong focus on customer experience. Government policies support digital trade, while investments in fintech and logistics infrastructure are on the rise, enhancing service efficiency and accessibility.

France : Diverse Market with Growth Potential

France's market value stands at $200.0 million, representing 20% of the European commerce as-a-service sector. The growth is driven by increasing consumer demand for online shopping and a vibrant startup ecosystem. Regulatory frameworks are evolving to support digital commerce, while government initiatives promote innovation in technology and logistics, facilitating market entry for new players.

Russia : Growth Amidst Regulatory Changes

Russia's commerce as-a-service market is valued at $150.0 million, making up 15% of the European market. Key growth drivers include a rising internet penetration rate and increasing consumer trust in online transactions. Regulatory changes are being implemented to enhance consumer protection and promote fair competition, while investments in digital infrastructure are crucial for market expansion.

Italy : Cultural Shift Towards Online Shopping

Italy's market is valued at $100.0 million, representing 10% of the European commerce as-a-service market. The growth is driven by a cultural shift towards e-commerce, particularly among younger consumers. Government initiatives are focused on digital transformation, while local businesses are increasingly adopting online platforms to reach broader audiences, supported by improved logistics and payment systems.

Spain : Digital Transformation in Retail

Spain's commerce as-a-service market is valued at $80.0 million, accounting for 8% of the European market. The growth is driven by a surge in online shopping, particularly in urban areas. Government policies are encouraging digital innovation, while local businesses are leveraging e-commerce platforms to enhance customer engagement and streamline operations, supported by advancements in logistics.

Rest of Europe : Varied Growth Across Regions

The Rest of Europe market is valued at $83.02 million, contributing to the overall commerce as-a-service landscape. Growth drivers vary significantly across countries, influenced by local consumer behavior and regulatory environments. Government initiatives are often tailored to specific national contexts, promoting digital commerce and innovation. The competitive landscape includes both local and international players, adapting to diverse market needs.