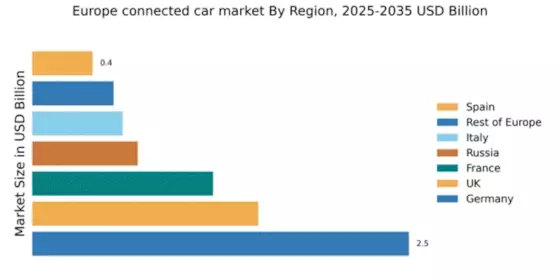

Germany : Innovation and Infrastructure Drive Growth

Key markets include cities like Munich, Stuttgart, and Berlin, where automotive giants like Volkswagen and BMW dominate. The competitive landscape is characterized by a mix of traditional manufacturers and new entrants like Tesla, which is rapidly expanding its footprint. Local dynamics favor innovation, with a focus on electric and autonomous vehicles. The presence of tech hubs fosters collaboration between automotive and tech industries, driving advancements in connected car technologies.

UK : Consumer Demand Fuels Expansion

Key markets include London, Manchester, and Birmingham, where urbanization drives the adoption of connected technologies. Major players like Ford and Nissan are investing heavily in the UK, while local startups are emerging in the tech space. The competitive landscape is vibrant, with a focus on integrating IoT and AI into vehicles. The automotive sector is increasingly collaborating with tech firms to enhance user experience and safety features.

France : Regulatory Support and Innovation

Key markets include Paris, Lyon, and Marseille, where urban mobility solutions are in high demand. Major players like Renault and Peugeot are leading the charge, while international brands like Toyota are also significant. The competitive landscape is marked by a blend of traditional automotive companies and innovative tech startups. The focus on sustainable transport solutions is shaping the business environment, with increasing collaboration across sectors.

Russia : Potential Amidst Challenges

Key markets include Moscow and St. Petersburg, where demand for connected features is growing. The competitive landscape is dominated by local manufacturers, but international players like Hyundai are making inroads. The business environment is evolving, with a focus on enhancing connectivity and safety features. The automotive sector is increasingly looking to integrate digital technologies to meet consumer expectations.

Italy : Cultural Shift Towards Connectivity

Key markets include Milan, Rome, and Turin, where urban mobility solutions are gaining traction. Major players like Fiat and BMW are prominent, while Tesla is expanding its presence. The competitive landscape is characterized by a mix of traditional automotive firms and tech startups. The focus on enhancing user experience and integrating smart technologies is shaping the local market dynamics.

Spain : Adoption Driven by Urbanization

Key markets include Madrid and Barcelona, where the adoption of connected technologies is on the rise. Major players like Nissan and Ford are active in the market, while local startups are emerging in the tech space. The competitive landscape is dynamic, with a focus on integrating IoT and AI into vehicles. The automotive sector is increasingly collaborating with tech firms to enhance user experience and safety features.

Rest of Europe : Varied Markets with Unique Dynamics

Key markets include cities across Scandinavia, Eastern Europe, and the Benelux region, where demand for connected features is growing. The competitive landscape varies significantly, with local manufacturers and international players like Toyota and Hyundai competing. The business environment is shaped by local regulations and consumer preferences, with a focus on enhancing connectivity and safety features in vehicles.