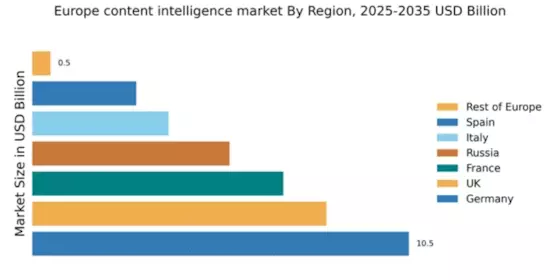

Germany : Strong Demand and Innovation Hub

Germany holds a commanding 10.5% market share in the European content intelligence sector, valued at approximately €1.2 billion. Key growth drivers include a robust digital transformation agenda, increasing demand for data-driven decision-making, and a focus on enhancing customer experiences. Government initiatives promoting AI and data analytics, alongside a well-developed infrastructure, further bolster market growth. The industrial landscape is evolving, with significant investments in technology and innovation.

UK : Innovation and Market Adaptability

The UK commands an 8.2% market share in the content intelligence market, valued at around €950 million. Growth is fueled by a strong emphasis on digital marketing strategies and the adoption of AI technologies. The demand for personalized content and enhanced customer engagement is rising, supported by favorable regulatory frameworks. The UK government is actively promoting digital skills development, which is crucial for sustaining market momentum.

France : Focus on Customer-Centric Solutions

France holds a 7.0% market share, translating to approximately €800 million in value. The market is driven by increasing investments in customer experience technologies and a growing emphasis on data privacy regulations. Demand for localized content solutions is on the rise, supported by government initiatives aimed at fostering innovation in digital services. The French market is characterized by a strong startup ecosystem, particularly in Paris and Lyon.

Russia : Regulatory Landscape and Opportunities

Russia's content intelligence market accounts for 5.5%, valued at about €650 million. Key growth drivers include a burgeoning tech sector and increasing internet penetration. However, regulatory challenges and geopolitical factors pose risks. The government is investing in digital infrastructure, which is expected to enhance market growth. Major cities like Moscow and St. Petersburg are central to market activities, with local players gaining traction against international competitors.

Italy : Cultural Richness Drives Demand

Italy's market share stands at 3.8%, valued at approximately €450 million. Growth is driven by the increasing need for localized content and digital marketing strategies tailored to diverse consumer preferences. Government initiatives supporting digital transformation in SMEs are pivotal. Key markets include Milan and Rome, where major players like Acrolinx are establishing a strong presence, fostering a competitive landscape that encourages innovation.

Spain : Digital Transformation on the Rise

Spain captures a 2.9% market share, valued at around €350 million. The market is experiencing growth due to rising digital content consumption and a shift towards data-driven marketing strategies. Government support for digital initiatives is enhancing the business environment. Key cities like Madrid and Barcelona are central to market activities, with both local and international players vying for market share, creating a vibrant competitive landscape.

Rest of Europe : Varied Growth Across Regions

The Rest of Europe holds a modest 0.51% market share, valued at approximately €60 million. This sub-region is characterized by diverse market needs and varying levels of digital maturity. Growth is driven by localized content demands and increasing internet access. Government initiatives across different countries aim to enhance digital capabilities. The competitive landscape is fragmented, with local players often dominating niche markets, adapting to specific regional requirements.

Leave a Comment