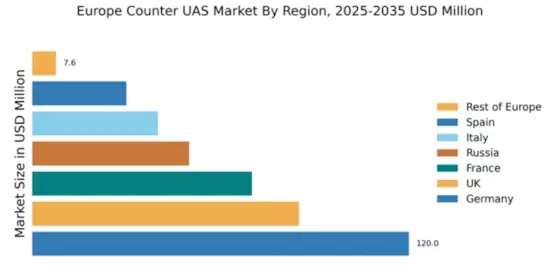

Germany : Strong Demand and Innovation Drive Growth

Key markets include Berlin, Munich, and Frankfurt, where major defense contractors like Lockheed Martin and Thales Group have established a strong presence. The competitive landscape is characterized by a mix of established players and emerging startups, fostering innovation. Local dynamics are influenced by stringent regulations and a collaborative environment between government and industry. Applications span various sectors, including public safety, military, and critical infrastructure protection.

UK : Government Initiatives Fuel Market Expansion

London and Manchester are pivotal markets, with significant investments in counter UAS technologies. Major players like BAE Systems and DroneShield are actively involved in developing innovative solutions. The competitive landscape is dynamic, with collaborations between public and private sectors driving advancements. The business environment is favorable, supported by government funding for research and development in defense technologies, particularly in urban security applications.

France : Innovation and Regulation Shape Market

Key markets include Paris and Toulouse, where major players like Thales Group are leading the charge in innovation. The competitive landscape features a mix of established defense contractors and innovative startups. Local market dynamics are influenced by government contracts and partnerships, fostering a collaborative environment. Applications extend across military, law enforcement, and critical infrastructure sectors, emphasizing the need for robust counter UAS solutions.

Russia : Defense Modernization Drives Demand

Moscow and St. Petersburg are key markets, with significant investments in defense technologies. Major players include local firms and international companies looking to establish a foothold. The competitive landscape is characterized by a mix of state-owned enterprises and private sector innovation. Local dynamics are influenced by government funding and a focus on military applications, particularly in border security and surveillance.

Italy : Strategic Partnerships Enhance Market Growth

Key markets include Rome and Milan, where major players like Leonardo are actively involved in developing counter UAS technologies. The competitive landscape features a mix of established defense contractors and innovative startups. Local market dynamics are influenced by government contracts and partnerships, fostering a collaborative environment. Applications span military, law enforcement, and critical infrastructure protection, emphasizing the need for robust counter UAS solutions.

Spain : Increased Investment in Security Technologies

Key markets include Madrid and Barcelona, where significant investments in counter UAS technologies are being made. Major players are beginning to establish a presence, with local firms collaborating with international companies. The competitive landscape is dynamic, with a focus on innovation and partnerships. Local dynamics are influenced by government funding for research and development in defense technologies, particularly in urban security applications.

Rest of Europe : Diverse Needs Across Sub-regions

Key markets include smaller nations like Belgium and the Netherlands, where local firms are beginning to explore counter UAS technologies. The competitive landscape is diverse, with a mix of established players and emerging startups. Local market dynamics are influenced by government initiatives and collaborations between public and private sectors. Applications vary widely, emphasizing the need for customized solutions to meet regional demands.