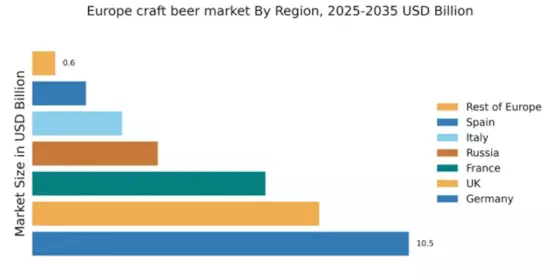

Germany : A Hub for Craft Beer Innovation

Key markets include cities like Berlin, Munich, and Hamburg, where craft breweries thrive. The competitive landscape features major players like Anheuser-Busch InBev and local craft breweries such as Berliner Kindl. The business environment is characterized by a strong community of craft beer enthusiasts and a growing number of beer festivals. Local dynamics favor innovation, with breweries experimenting with unique flavors and sustainable practices, catering to a diverse consumer base.

UK : A Thriving Market for Artisans

Key markets include London, Manchester, and Bristol, where craft beer bars and festivals flourish. The competitive landscape features prominent players like BrewDog and Camden Town Brewery, alongside numerous local artisans. The business environment is dynamic, with a strong emphasis on innovation and sustainability. Local breweries often collaborate on limited-edition brews, creating a sense of community and excitement in the market.

France : A New Wave of Brewing Culture

Key markets include Paris, Lyon, and Strasbourg, where craft beer bars and festivals are gaining popularity. The competitive landscape features established players like Kronenbourg and a plethora of local craft breweries. The business environment is becoming more favorable, with local breweries focusing on unique flavors and collaborations. The sector is also seeing increased interest from the gastronomy industry, integrating craft beer into fine dining.

Russia : Emerging Market with Potential

Key markets include Moscow and St. Petersburg, where craft beer bars are becoming more common. The competitive landscape features both local and international players, with brands like Baltika and local craft breweries emerging. The business environment is evolving, with a growing number of craft beer festivals and events. Local breweries are focusing on innovation, experimenting with flavors and brewing techniques to attract a diverse consumer base.

Italy : A Blend of Tradition and Innovation

Key markets include cities like Milan, Rome, and Florence, where craft beer culture is rapidly expanding. The competitive landscape features established brands like Birra Moretti alongside numerous local craft breweries. The business environment is characterized by a strong emphasis on quality and innovation, with local breweries often collaborating with chefs to create unique pairings. The sector is also seeing increased interest from the tourism industry, integrating craft beer experiences into travel itineraries.

Spain : A Growing Taste for Craft

Key markets include Barcelona and Madrid, where craft beer bars and festivals are gaining traction. The competitive landscape features both local and international players, with brands like Estrella Damm and a growing number of craft breweries. The business environment is becoming more favorable, with local breweries focusing on unique flavors and sustainable practices. The sector is also seeing increased collaboration with the gastronomy industry, integrating craft beer into culinary experiences.

Rest of Europe : Diverse Opportunities Across Regions

Key markets include countries like Belgium, the Netherlands, and the Nordic regions, where craft beer culture is gaining momentum. The competitive landscape features a mix of local and international players, with a focus on innovation and quality. The business environment is diverse, with local breweries often collaborating on unique brews and participating in regional festivals. The sector is also seeing increased interest from the tourism industry, integrating craft beer experiences into travel itineraries.