Automotive Industry Growth

The growth of the automotive industry is a significant driver for the Europe Aluminum Plate Market, as manufacturers increasingly adopt aluminum to enhance vehicle performance and fuel efficiency. The shift towards lightweight materials in vehicle design is driven by stringent emissions regulations and consumer demand for more efficient vehicles. According to industry reports, the use of aluminum in automotive applications is projected to rise, with aluminum plates being utilized in various components such as body panels and structural parts. This trend is further supported by the European automotive sector's commitment to sustainability, as aluminum is fully recyclable. Consequently, the expansion of the automotive industry is likely to propel the demand for aluminum plates, thereby positively influencing the Europe Aluminum Plate Market.

Infrastructure Development

Infrastructure development is a critical driver of the Europe Aluminum Plate Market, as governments and private sectors invest heavily in construction projects. The European Commission has allocated substantial funding for infrastructure initiatives, including transportation networks, bridges, and buildings, which often utilize aluminum plates due to their lightweight and durable properties. For instance, the EU's investment in green infrastructure projects is likely to increase the demand for aluminum plates, as they are essential for sustainable construction practices. Additionally, the ongoing urbanization in various European countries is expected to further fuel the need for aluminum plates in residential and commercial buildings. As a result, the infrastructure boom is anticipated to significantly impact the growth trajectory of the Europe Aluminum Plate Market.

Sustainability Initiatives

The Europe Aluminum Plate Market is increasingly influenced by sustainability initiatives aimed at reducing carbon footprints. Governments across Europe are implementing stringent regulations to promote eco-friendly practices. For instance, the European Union's Green Deal aims to make Europe climate-neutral by 2050, which encourages industries to adopt sustainable materials like aluminum. This shift is likely to drive demand for aluminum plates, as they are recyclable and have a lower environmental impact compared to other materials. Furthermore, companies are investing in green technologies to enhance production efficiency, which may lead to a surge in the use of aluminum plates in various applications, including automotive and construction. As a result, the focus on sustainability is expected to significantly shape the future of the Europe Aluminum Plate Market.

Technological Advancements

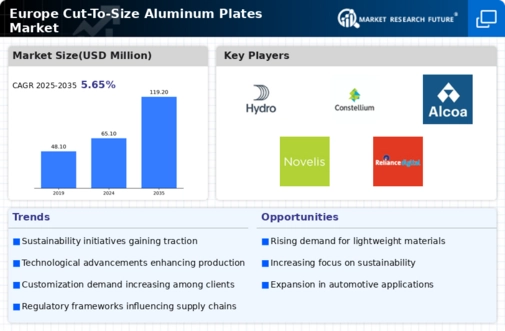

Technological advancements play a pivotal role in shaping the Europe Aluminum Plate Market. Innovations in manufacturing processes, such as advanced casting and rolling techniques, have enhanced the quality and performance of aluminum plates. For example, the introduction of automated production lines has increased efficiency and reduced production costs, making aluminum plates more accessible to various sectors. Additionally, the development of high-strength aluminum alloys has expanded the application range of aluminum plates, particularly in aerospace and automotive industries. According to recent data, the European aluminum market is projected to grow at a CAGR of approximately 4% from 2023 to 2028, driven by these technological improvements. Consequently, the ongoing evolution of technology is likely to bolster the competitiveness of the Europe Aluminum Plate Market.

Customization and Specialization

Customization and specialization are emerging trends within the Europe Aluminum Plate Market, as manufacturers strive to meet the diverse needs of end-users. Industries such as aerospace, automotive, and construction require specific aluminum plate characteristics, including thickness, alloy composition, and surface finish. This demand for tailored solutions has prompted manufacturers to invest in specialized production capabilities. For instance, companies are increasingly offering bespoke aluminum plate solutions to cater to unique project requirements, which may enhance customer satisfaction and loyalty. Market data indicates that the demand for customized aluminum products is on the rise, with a notable increase in orders for specialized plates. This trend is expected to drive growth in the Europe Aluminum Plate Market, as businesses seek to differentiate themselves through unique offerings.