Growth in the Furniture Sector

The furniture industry in Europe significantly influences the decorative laminates market, as these materials are extensively used in the production of various furniture items. The increasing trend of modular and ready-to-assemble furniture has led to a higher demand for decorative laminates, which provide both aesthetic appeal and functional benefits. Market analysis suggests that the furniture sector accounts for nearly 40% of the total consumption of decorative laminates in Europe. This growth is attributed to the rising disposable incomes and changing lifestyles of consumers, who are willing to invest in high-quality furniture that incorporates decorative laminates. Consequently, the decorative laminates market is poised for expansion as furniture manufacturers continue to adopt these materials in their designs.

Expansion of the Construction Sector

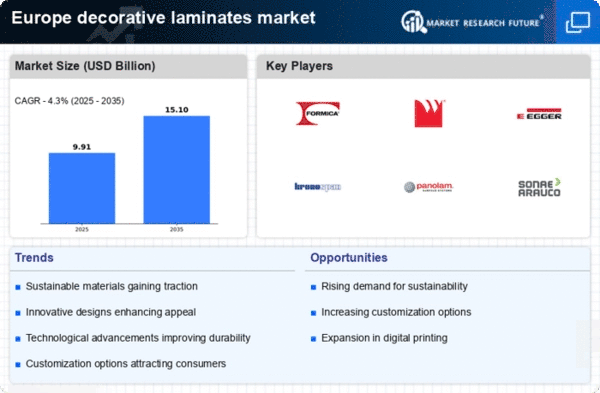

The construction sector in Europe plays a pivotal role in driving the decorative laminates market. With ongoing urban development and infrastructure projects, there is a heightened demand for decorative laminates in both residential and commercial applications. The market is projected to witness a growth rate of around 4% annually, largely due to the increasing number of construction projects and renovations. Decorative laminates are favored for their cost-effectiveness and design flexibility, making them a popular choice among architects and builders. As the construction sector continues to expand, the decorative laminates market is likely to benefit from this trend, with manufacturers focusing on providing innovative solutions tailored to the needs of the construction market.

Rising Demand for Aesthetic Interiors

The decorative laminates market in Europe experiences a notable surge in demand driven by the increasing consumer preference for aesthetically pleasing interiors. As urbanization continues to rise, homeowners and businesses alike seek materials that enhance the visual appeal of their spaces. This trend is particularly evident in the residential sector, where decorative laminates are favored for their versatility and design options. The market data indicates that the demand for decorative laminates in Europe is projected to grow at a CAGR of approximately 6% over the next five years. This growth is fueled by the desire for personalized and stylish environments, prompting manufacturers to innovate and expand their product offerings in the decorative laminates market.

Technological Innovations in Production

Technological advancements in the production processes of decorative laminates are reshaping the market landscape in Europe. Innovations such as digital printing and advanced surface treatments enhance the quality and design possibilities of laminates, making them more appealing to consumers. These technologies allow for greater customization and the ability to replicate natural materials, which is increasingly sought after in interior design. The decorative laminates market benefits from these advancements, as they not only improve product quality but also reduce production costs. As a result, manufacturers are likely to invest in these technologies to remain competitive, potentially leading to a market growth rate of around 5% annually over the next few years.

Sustainability and Eco-Friendly Products

The growing emphasis on sustainability in Europe significantly impacts the decorative laminates market. Consumers are increasingly inclined towards eco-friendly products, prompting manufacturers to adopt sustainable practices in their production processes. This shift includes the use of recycled materials and low-emission adhesives, aligning with the broader environmental goals of the region. Market data indicates that the demand for eco-friendly decorative laminates is expected to rise by approximately 7% annually, as consumers prioritize sustainability in their purchasing decisions. The decorative laminates market is thus adapting to these preferences, with companies investing in sustainable product lines to capture this emerging segment of environmentally conscious consumers.