Economic Recovery and Industrial Growth

The diesel engines market in Europe is poised for growth as economic recovery and industrial activities gain momentum. Following a period of economic stagnation, various sectors, including manufacturing and logistics, are witnessing a resurgence. This recovery is reflected in the increasing demand for commercial vehicles powered by diesel engines, which are favored for their fuel efficiency and durability. The European automotive industry, a significant contributor to the diesel engines market, is projected to grow by 5% annually, driven by rising consumer confidence and increased spending. Furthermore, the demand for diesel engines in sectors such as agriculture and construction is expected to rise, as these industries rely heavily on diesel-powered equipment. This economic landscape suggests a favorable outlook for the diesel engines market, as industries seek reliable power solutions to support their growth.

Environmental Regulations and Compliance

The diesel engines market in Europe is significantly influenced by stringent environmental regulations aimed at reducing emissions. The European Union has implemented various directives to limit NOx and particulate emissions from diesel engines, compelling manufacturers to innovate and comply with these standards. The introduction of the Euro 6 emission standards has led to the development of cleaner diesel technologies, which are essential for maintaining market competitiveness. As of 2025, it is estimated that compliance costs for manufacturers could reach up to €1 billion annually, as they invest in advanced technologies to meet these regulations. This regulatory landscape not only drives innovation but also shapes consumer preferences, as buyers increasingly seek vehicles that align with environmental standards. Consequently, The diesel engines market will need to adapt to these evolving regulations to sustain its relevance in the automotive sector..

Infrastructure Development and Investment

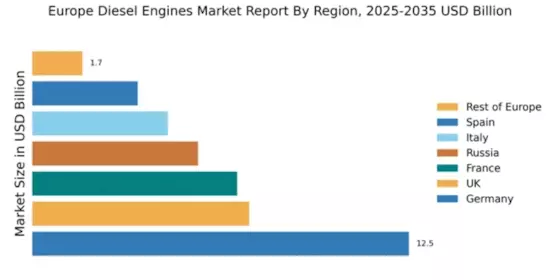

Infrastructure development plays a pivotal role in shaping the diesel engines market in Europe. The ongoing investments in transportation infrastructure, including roads, railways, and ports, are driving the demand for heavy-duty diesel engines. According to recent reports, the European construction sector is expected to grow by 4% annually, leading to increased usage of diesel-powered machinery and vehicles. This trend is particularly evident in countries like Germany and France, where government initiatives are aimed at enhancing logistics and transportation networks. The diesel engines market is likely to benefit from this growth. Diesel engines are preferred for their reliability and efficiency in heavy-duty applications.. Additionally, the push for sustainable infrastructure projects may lead to innovations in diesel technology, further solidifying its position in the market.

Technological Advancements in Diesel Engines

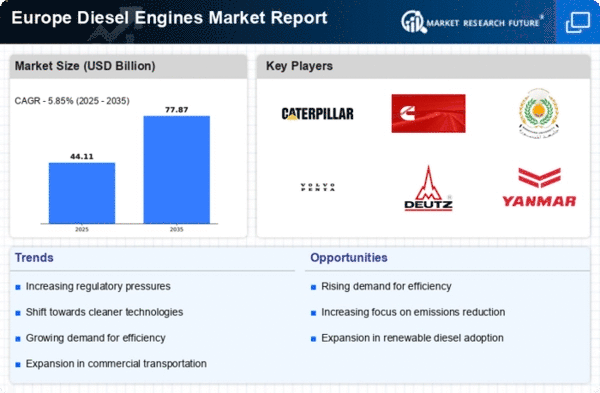

The diesel engines market in Europe is experiencing a notable transformation due to rapid technological advancements. Innovations such as turbocharging, direct fuel injection, and advanced exhaust after-treatment systems are enhancing engine efficiency and reducing emissions. These developments are crucial as the European Union aims to meet stringent environmental regulations. The market is projected to grow at a CAGR of approximately 3.5% from 2025 to 2030, driven by the demand for cleaner and more efficient diesel engines. Furthermore, manufacturers are investing heavily in research and development to create engines that comply with the Euro 6 standards, which mandate lower NOx and particulate matter emissions. This focus on technology not only improves performance but also positions the diesel engines market favorably against alternative fuel options.

Shifts in Energy Policies and Fuel Availability

The diesel engines market in Europe is navigating a complex landscape shaped by shifts in energy policies and fuel availability. As countries transition towards renewable energy sources, the availability of diesel fuel may face challenges, impacting the market dynamics. However, diesel engines remain a vital component of the energy mix, particularly in transportation and heavy industries. The European Commission's commitment to reducing greenhouse gas emissions by 55% by 2030 may lead to increased scrutiny of fossil fuels, including diesel. Despite this, the current infrastructure for diesel fuel distribution remains robust, ensuring its continued availability. The diesel engines market could potentially benefit from advancements in bio-diesel and synthetic fuels, which may offer a more sustainable alternative while retaining the performance characteristics of traditional diesel engines. This evolving energy landscape presents both challenges and opportunities for the diesel engines market.