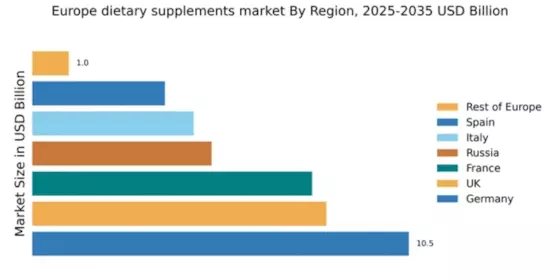

Germany : Strong Demand and Innovation Drive Growth

Key markets include Berlin, Munich, and Hamburg, where urban populations are increasingly turning to dietary supplements. The competitive landscape features major players like Herbalife, Amway, and GNC Holdings, which dominate the market with diverse product offerings. Local dynamics are characterized by a strong preference for organic and plant-based supplements, reflecting consumer trends towards sustainability. The presence of well-established distribution channels supports the growth of this sector.

UK : Evolving Consumer Preferences Shape Market

Key markets include London, Manchester, and Birmingham, where urban populations are more inclined to invest in health supplements. The competitive landscape is vibrant, with players like Nature's Bounty and NOW Foods making significant inroads. Local dynamics reflect a shift towards personalized nutrition, with many consumers seeking tailored supplement solutions. The online retail sector is booming, providing easy access to a wide range of products.

France : Quality and Tradition Drive Demand

Key markets include Paris, Lyon, and Marseille, where affluent consumers are more likely to invest in dietary supplements. The competitive landscape features major players like USANA Health Sciences and Optimum Nutrition, which cater to diverse consumer needs. Local dynamics emphasize the importance of natural ingredients, with a growing trend towards clean-label products. The market is also influenced by the beauty and wellness sectors, integrating supplements into holistic health approaches.

Russia : Growing Demand Amidst Regulatory Changes

Key markets include Moscow and St. Petersburg, where urban populations are more health-conscious. The competitive landscape is evolving, with both local and international players like Herbalife and GNC Holdings vying for market share. Local dynamics are influenced by a growing interest in fitness and wellness, leading to increased consumption of protein supplements and vitamins. The market is also seeing a rise in online sales channels, enhancing accessibility for consumers.

Italy : Cultural Heritage Influences Choices

Key markets include Milan, Rome, and Naples, where consumers are more inclined to invest in health products. The competitive landscape features major players like Nature's Bounty and NOW Foods, which cater to diverse consumer preferences. Local dynamics reflect a strong inclination towards herbal and organic supplements, with a growing trend in functional foods. The market is also supported by a robust retail network, including pharmacies and health food stores.

Spain : Rising Popularity of Natural Products

Key markets include Madrid, Barcelona, and Valencia, where urban populations are increasingly adopting health supplements. The competitive landscape features players like Herbalife and USANA Health Sciences, which are gaining traction. Local dynamics emphasize the importance of natural and organic products, with a growing trend towards plant-based supplements. The online retail sector is expanding, providing consumers with greater access to a variety of products.

Rest of Europe : Diverse Trends Across Smaller Regions

Key markets include countries like Belgium, Netherlands, and Switzerland, where health supplements are gaining popularity. The competitive landscape is fragmented, with both local and international players competing for market share. Local dynamics reflect diverse consumer preferences, with a growing interest in personalized nutrition and wellness products. The market is also seeing an increase in online sales channels, enhancing accessibility for consumers.