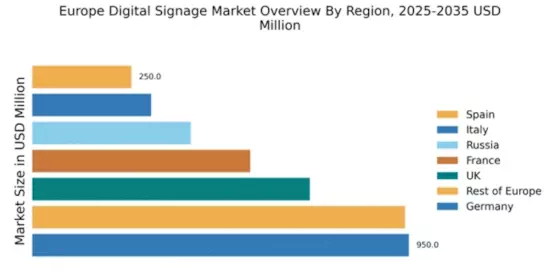

Germany : Strong Growth Driven by Innovation

Germany holds a dominant position in the European digital signage market, with a value of $950.0 million, representing approximately 30% of the total market share. Key growth drivers include a robust economy, increasing demand for interactive displays, and significant investments in smart city initiatives. Regulatory support for digital infrastructure and a focus on sustainability further enhance market potential. The industrial sector is rapidly adopting digital signage for advertising and information dissemination, reflecting a shift in consumption patterns towards more engaging content.

UK : Innovation Meets Consumer Engagement

The UK digital signage market is valued at $700.0 million, accounting for about 22% of the European market. Growth is fueled by the rise of e-commerce and the need for enhanced customer experiences in retail environments. Government initiatives promoting digital transformation and infrastructure upgrades are pivotal. The demand for digital signage in sectors like retail, transportation, and hospitality is on the rise, reflecting changing consumer behaviors and preferences.

France : Cultural Richness Drives Demand

France's digital signage market is valued at $550.0 million, representing roughly 18% of the European market. The growth is driven by the country's cultural emphasis on visual communication and advertising. Government policies supporting digital innovation and urban development initiatives are key factors. The market is witnessing increased adoption in sectors such as tourism, retail, and public transport, where engaging displays enhance user experience and information dissemination.

Russia : Market Growth Amidst Challenges

Russia's digital signage market is valued at $400.0 million, making up about 13% of the European market. Key growth drivers include urbanization and the increasing need for modern advertising solutions. However, regulatory challenges and economic fluctuations pose risks. Major cities like Moscow and St. Petersburg are leading the demand, with significant investments in public infrastructure and retail spaces. Local players are emerging, but international brands like Samsung and LG maintain a strong presence.

Italy : Cultural Heritage Meets Technology

Italy's digital signage market is valued at $300.0 million, representing about 10% of the European market. Growth is driven by the tourism sector, where digital displays enhance visitor experiences in historical sites and museums. Government initiatives promoting digital innovation in public spaces are also significant. Key markets include Rome and Milan, where competition is intensifying among local and international players, including NEC and Sony, focusing on retail and hospitality applications.

Spain : Tourism Fuels Digital Growth

Spain's digital signage market is valued at $250.0 million, accounting for approximately 8% of the European market. The tourism sector is a primary growth driver, with digital signage enhancing visitor engagement in cities like Barcelona and Madrid. Government support for smart city projects and digital infrastructure is crucial. The competitive landscape features both local and international players, with applications spanning retail, transportation, and entertainment sectors.

Rest of Europe : Varied Growth Across Regions

The Rest of Europe digital signage market is valued at $940.2 million, representing about 30% of the total market. Growth is driven by diverse regional demands, including retail, transportation, and corporate sectors. Government initiatives promoting digital transformation and infrastructure development are key. Countries like the Netherlands and Belgium are emerging markets, with a mix of local and international players competing for market share, focusing on innovative applications and solutions.