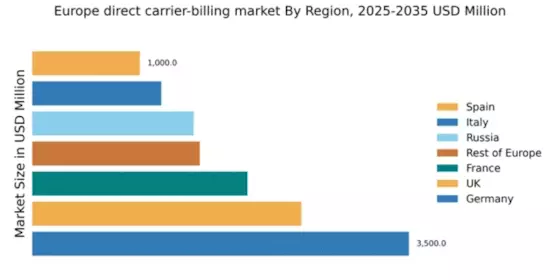

Germany : Germany's Dominance in Carrier Billing

Germany holds a commanding market share of 35% in the European direct carrier-billing sector, valued at $3,500.0 million. Key growth drivers include a robust digital economy, increasing smartphone penetration, and a shift towards cashless transactions. Regulatory support from the Federal Network Agency has fostered a conducive environment for innovation. Additionally, advancements in mobile network infrastructure have enhanced service delivery and consumer access.

UK : UK's Expanding Carrier Billing Market

The UK accounts for 25% of the European market, valued at $2,500.0 million. Growth is driven by high smartphone usage and a growing preference for in-app purchases. The UK government has implemented favorable regulations to support mobile payment solutions, enhancing consumer trust. The competitive landscape is characterized by a mix of local and international players, with a focus on user-friendly payment experiences.

France : France's Dynamic Billing Landscape

France captures 20% of the market, valued at $2,000.0 million. The growth is fueled by increasing digital content consumption and a rise in mobile gaming. Regulatory frameworks from the Autorité de régulation des communications électroniques and government initiatives promote secure payment methods. The market is vibrant, with Paris as a key hub for tech startups and established players like MobiWire leading the charge.

Russia : Russia's Growing Carrier Billing Sector

Russia holds a 15% market share, valued at $1,500.0 million. The growth is driven by a young, tech-savvy population and increasing internet penetration. Government initiatives aimed at digital transformation support the sector's expansion. Major cities like Moscow and St. Petersburg are key markets, with local players competing alongside international firms, creating a dynamic business environment.

Italy : Italy's Evolving Billing Ecosystem

Italy represents 12% of the market, valued at $1,200.0 million. Growth is supported by rising smartphone adoption and a shift towards digital services. Regulatory bodies are working to enhance consumer protection in mobile payments. Key markets include Milan and Rome, where competition is intensifying among local and international players, fostering innovation in payment solutions.

Spain : Spain's Expanding Digital Economy

Spain accounts for 10% of the market, valued at $1,000.0 million. The growth is driven by increasing mobile internet usage and a preference for seamless payment solutions. The Spanish government is actively promoting digital payment initiatives, enhancing market confidence. Major cities like Madrid and Barcelona are central to the competitive landscape, with Telefónica playing a significant role.

Rest of Europe : Varied Dynamics Across Europe

The Rest of Europe holds a market share of 16% valued at $1,558.0 million. Growth varies significantly across countries, influenced by local regulations and consumer behavior. The European Commission's initiatives to harmonize digital payment regulations are crucial for market development. Key players include regional firms adapting to local needs, creating a diverse competitive landscape.