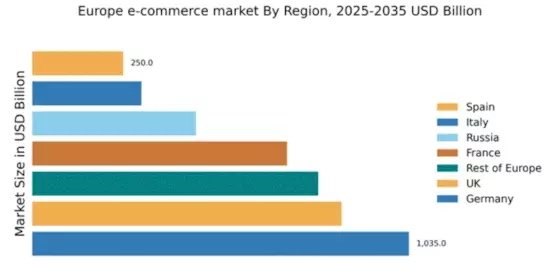

Germany : Robust Growth and Innovation Hub

Germany holds a commanding market share of 30.5% in the European e-commerce sector, valued at $1,035.0 billion. Key growth drivers include a strong digital infrastructure, high internet penetration, and a growing preference for online shopping. Regulatory support, such as the Digital Strategy 2025, aims to enhance e-commerce frameworks. The country also benefits from a well-developed logistics network, facilitating efficient delivery services.

UK : Innovation Meets Consumer Demand

The UK e-commerce market, valued at $850.0 billion, represents 25.5% of the European total. Growth is fueled by a tech-savvy population and increasing mobile commerce. The UK government has implemented policies to support digital trade, including the Digital Economy Act. The market is characterized by a shift towards sustainable practices, with consumers favoring eco-friendly products and services.

France : Cultural Trends Drive Online Sales

France's e-commerce market is valued at $700.0 billion, accounting for 21.5% of the European market. Growth is driven by a strong cultural affinity for online shopping and increasing smartphone usage. Government initiatives, such as the French Tech program, support digital innovation. The logistics sector is also evolving, with investments in last-mile delivery solutions enhancing customer experience.

Russia : Rapid Growth and Digital Adoption

Russia's e-commerce market, valued at $450.0 billion, represents 13.7% of the European total. Key growth drivers include a young, tech-savvy population and increasing internet access. Government initiatives, such as the Digital Economy Program, aim to boost online retail. The market is characterized by a diverse range of products, with electronics and fashion leading in demand.

Italy : Cultural Shifts Fuel Online Growth

Italy's e-commerce market is valued at $300.0 billion, making up 9.2% of the European market. Growth is driven by changing consumer habits, with more Italians embracing online shopping. Government support through initiatives like the National Industry 4.0 Plan aims to enhance digital capabilities. The market is competitive, with local players like Yoox and international giants like Amazon vying for market share.

Spain : Digital Transformation in Retail

Spain's e-commerce market, valued at $250.0 billion, accounts for 7.7% of the European total. The growth is driven by increasing internet penetration and a shift towards online shopping, particularly in urban areas. Government initiatives, such as the Spain Digital 2025 agenda, aim to enhance digital infrastructure. The competitive landscape includes local players like El Corte Inglés and global giants like Amazon.

Rest of Europe : Varied Markets and Consumer Preferences

The Rest of Europe, with a market value of $785.84 billion, represents 24.1% of the European e-commerce sector. This diverse region includes various markets with unique consumer preferences and regulatory environments. Growth is driven by increasing internet access and mobile commerce. Local players and international giants compete in sectors like fashion, electronics, and home goods, adapting to regional demands.