Increasing Regulatory Pressure

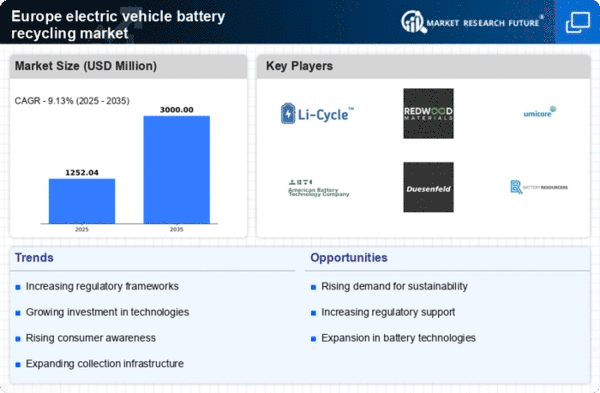

The electric vehicle-battery-recycling market in Europe is under increasing regulatory pressure, which is driving the need for effective recycling solutions. The European Union has implemented stringent regulations aimed at ensuring that battery manufacturers are responsible for the entire lifecycle of their products. For instance, the Battery Directive mandates that 65% of the weight of batteries must be recycled by 2025. This regulatory framework compels manufacturers to invest in recycling technologies and processes, thereby expanding the electric vehicle-battery-recycling market. As compliance becomes a necessity, companies are likely to seek partnerships with recycling firms to meet these requirements, further propelling market growth.

Consumer Awareness and Education

Consumer awareness and education are emerging as critical drivers in the electric vehicle-battery-recycling market in Europe. As the public becomes more informed about the environmental impacts of battery disposal, there is a growing demand for transparent recycling practices. Educational campaigns led by governments and non-profit organizations are raising awareness about the importance of recycling batteries and the potential hazards of improper disposal. This heightened awareness is likely to influence consumer behavior, leading to increased participation in recycling programs. Consequently, the electric vehicle-battery-recycling market may see a rise in demand for accessible recycling options, as consumers seek to contribute to sustainable practices.

Rising Demand for Sustainable Practices

The electric vehicle battery recycling market in Europe is experiencing a notable surge in demand for sustainable practices. As consumers become increasingly environmentally conscious, the pressure on manufacturers to adopt eco-friendly solutions intensifies. This shift is reflected in the European Union's commitment to reducing carbon emissions by at least 55% by 2030. Consequently, the electric vehicle-battery-recycling market is poised for growth, as companies seek to align with these sustainability goals. The market is projected to reach €2 billion by 2027, driven by the need for responsible disposal and recycling of lithium-ion batteries. This demand for sustainable practices not only enhances brand reputation but also meets regulatory requirements, thereby fostering a more circular economy.

Technological Innovations in Battery Recycling

Technological innovations are playing a pivotal role in shaping the electric vehicle-battery-recycling market in Europe. Advanced recycling technologies, such as hydrometallurgical and pyrometallurgical processes, are being developed to improve recovery rates of valuable materials like lithium, cobalt, and nickel. These innovations are crucial, as they can potentially increase recovery rates to over 90%, significantly reducing the need for virgin materials. Furthermore, the European Commission has set ambitious targets for battery recycling, aiming for a minimum of 50% of lithium-ion batteries to be recycled by 2030. This technological advancement not only enhances the efficiency of recycling processes but also contributes to the overall sustainability of the electric vehicle industry.

Growing Investment in Circular Economy Initiatives

Investment in circular economy initiatives is significantly influencing the electric vehicle-battery-recycling market in Europe. Governments and private sectors are increasingly recognizing the economic and environmental benefits of recycling and reusing materials. The European Union has allocated substantial funding to support projects that promote circular economy practices, with an estimated €1 billion earmarked for battery recycling initiatives by 2026. This financial backing encourages innovation and collaboration among stakeholders, fostering a robust ecosystem for battery recycling. As a result, the electric vehicle-battery-recycling market is likely to expand, driven by the influx of investment aimed at creating sustainable solutions for battery waste.