Rising Environmental Concerns

Rising environmental concerns regarding battery waste and resource depletion are propelling the electric vehicle-battery-recycling market forward. As awareness of the ecological impact of battery disposal grows, consumers and businesses alike are advocating for sustainable practices. The electric vehicle-battery-recycling market is responding to this demand by developing more robust recycling programs and solutions. Reports indicate that improper disposal of lithium-ion batteries can lead to hazardous waste, prompting regulatory bodies to enforce stricter guidelines. This heightened focus on environmental responsibility is likely to drive investments in recycling technologies and infrastructure, ensuring that the electric vehicle-battery-recycling market can meet the increasing expectations of environmentally conscious consumers.

Government Incentives and Policies

Government incentives and policies play a crucial role in shaping the electric vehicle-battery-recycling market. In recent years, various federal and state initiatives have been introduced to promote recycling and sustainable practices. For instance, tax credits and grants for recycling facilities encourage investment in the electric vehicle-battery-recycling market. Additionally, regulations mandating the recycling of electric vehicle batteries are becoming more prevalent, further driving market growth. The U.S. government has allocated substantial funding, estimated at $2 billion, to support battery recycling initiatives. These policies not only aim to reduce waste but also to create a circular economy for battery materials, ensuring that valuable resources are reused and minimizing environmental harm.

Increasing Electric Vehicle Adoption

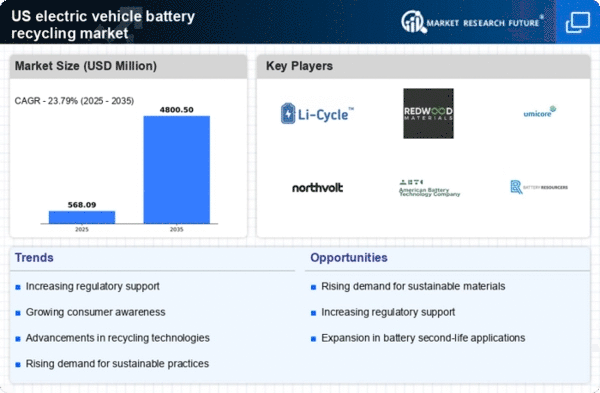

The rapid rise in electric vehicle adoption in the United States is a primary driver for the electric vehicle-battery-recycling market. As of 2025, electric vehicle sales have surged, with projections indicating that they could account for over 30% of total vehicle sales by 2030. This increase in electric vehicle usage leads to a corresponding rise in battery production and, consequently, battery waste. The electric vehicle-battery-recycling market is poised to benefit from this trend, as more batteries reach the end of their life cycle. The need for effective recycling solutions becomes critical to manage the environmental impact of discarded batteries. Furthermore, the recycling of lithium-ion batteries can recover valuable materials, potentially reducing the need for new raw materials and enhancing sustainability efforts within the automotive industry.

Market Demand for Recycled Materials

The demand for recycled materials in the electric vehicle-battery-recycling market is on the rise, driven by the need for sustainable sourcing of battery components. As the electric vehicle industry expands, manufacturers are increasingly seeking recycled materials to reduce production costs and environmental impact. The market for recycled lithium, cobalt, and nickel is projected to grow significantly, with estimates suggesting a potential increase of 25% in demand by 2030. This trend not only supports the electric vehicle-battery-recycling market but also encourages the development of closed-loop systems where materials are reused, minimizing the need for virgin resources. Consequently, the electric vehicle-battery-recycling market is becoming an integral part of the supply chain for electric vehicle manufacturers, aligning with their sustainability objectives.

Technological Innovations in Recycling

Technological innovations are transforming the electric vehicle-battery-recycling market, enhancing efficiency and effectiveness in recycling processes. Advanced techniques, such as hydrometallurgical and pyrometallurgical methods, are being developed to recover critical materials like lithium, cobalt, and nickel from used batteries. These innovations can potentially increase recovery rates to over 90%, making recycling more economically viable. Furthermore, the integration of artificial intelligence and automation in recycling facilities is streamlining operations, reducing costs, and improving safety. As technology continues to evolve, the electric vehicle-battery-recycling market is likely to see increased investment and growth, driven by the demand for more efficient recycling solutions that align with sustainability goals.