Growing Focus on Energy Security

Energy security remains a pivotal concern for European nations, influencing the gas turbine market significantly. The need for reliable and stable energy sources has prompted governments to prioritize investments in gas turbine technologies, which can provide baseload and peak-load power generation. This focus on energy security is particularly relevant in the context of geopolitical tensions and the need to diversify energy sources. The gas turbine market is likely to see increased demand as countries seek to bolster their energy independence and reduce reliance on imported fuels. As a result, the market may experience a growth rate of around 6% annually, driven by the strategic importance of gas turbines in national energy policies.

Regulatory Support for Clean Energy

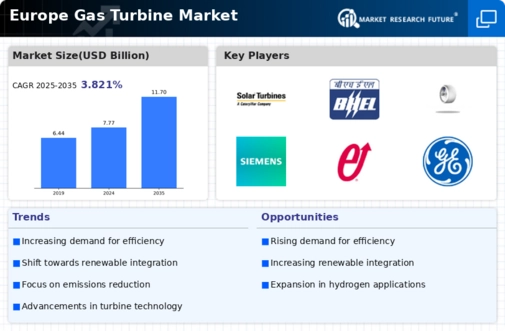

The gas turbine market in Europe is experiencing a notable boost due to regulatory frameworks that favor cleaner energy solutions. Governments are implementing stringent emissions regulations, which compel industries to adopt technologies that reduce carbon footprints. For instance, the European Union's Green Deal aims to make Europe climate-neutral by 2050, promoting investments in low-emission technologies. This regulatory support is likely to drive the demand for advanced gas turbines, which can operate efficiently with lower emissions. The gas turbine market is thus positioned to benefit from these policies, as companies seek to comply with regulations while maintaining operational efficiency. The market is projected to grow at a CAGR of approximately 4.5% over the next five years, driven by these supportive measures.

Investment in Infrastructure Development

Infrastructure development plays a crucial role in shaping the gas turbine market in Europe. Significant investments in energy infrastructure, including the construction of new power plants and the upgrading of existing facilities, are driving the demand for gas turbines. Governments and private entities are allocating substantial funds to enhance energy generation capabilities, with a focus on integrating cleaner technologies. For instance, the European Investment Bank has committed to financing projects that support the transition to sustainable energy systems. This influx of capital is likely to stimulate growth in the gas turbine market, as manufacturers respond to the increasing demand for efficient and reliable power generation solutions. The market is projected to benefit from these investments, with an anticipated increase in market size by €15 billion over the next decade.

Rising Demand for Flexible Power Generation

The gas turbine market in Europe is witnessing a surge in demand for flexible power generation solutions. As the energy landscape evolves, there is a growing need for power plants that can quickly adjust output to match fluctuating energy demands, particularly with the increasing integration of intermittent renewable energy sources. Gas turbines are well-suited for this role due to their rapid start-up times and operational flexibility. This trend is further supported by the European Commission's initiatives to enhance energy security and reliability. The gas turbine market is thus likely to expand as utilities and independent power producers invest in flexible gas turbine technologies. It is estimated that the market could grow by approximately 5% annually as more operators seek to modernize their fleets to accommodate these changing dynamics.

Technological Advancements in Turbine Design

Innovations in turbine design are significantly influencing the gas turbine market in Europe. Manufacturers are increasingly focusing on developing high-efficiency gas turbines that can operate at elevated temperatures and pressures, thereby enhancing performance and reducing fuel consumption. The introduction of advanced materials and cooling technologies has led to turbines that can achieve efficiencies exceeding 60%. This technological evolution not only improves the operational capabilities of gas turbines but also aligns with the industry's shift towards sustainability. As a result, the gas turbine market is likely to see increased investments in R&D, with companies aiming to enhance their product offerings and maintain competitive advantages. The market's growth trajectory is expected to be positively impacted by these advancements, potentially leading to a market value increase of over €10 billion by 2030.