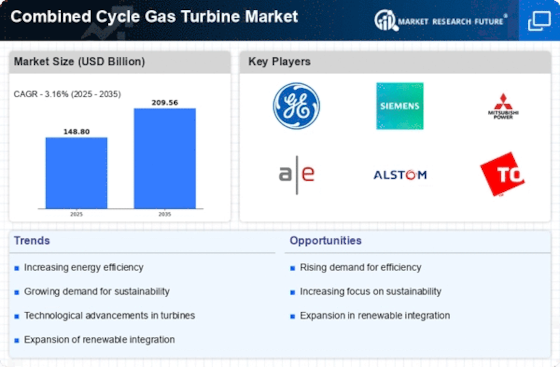

The Combined Cycle Gas Turbine Market is currently characterized by a dynamic competitive landscape, driven by the increasing demand for efficient and sustainable energy solutions. Key players such as General Electric (US), Siemens (DE), and Mitsubishi Power (JP) are at the forefront, each adopting distinct strategies to enhance their market positioning. General Electric (US) emphasizes innovation in turbine technology, focusing on digital solutions to optimize performance and reduce emissions. Siemens (DE) is actively pursuing regional expansion, particularly in emerging markets, while also investing in partnerships to bolster its technological capabilities. Mitsubishi Power (JP) appears to be concentrating on sustainability initiatives, integrating renewable energy sources into its combined cycle systems, thereby aligning with global decarbonization goals. Collectively, these strategies contribute to a competitive environment that is increasingly focused on technological advancement and sustainability.

In terms of business tactics, companies are localizing manufacturing to reduce costs and enhance supply chain efficiency. This approach is particularly relevant in a moderately fragmented market where regional players also exert influence. The competitive structure is shaped by the collective actions of these key players, who are not only vying for market share but also striving to set industry standards through innovation and operational excellence.

In August 2025, General Electric (US) announced a strategic partnership with a leading renewable energy firm to develop hybrid power solutions that integrate gas turbines with solar energy. This move is significant as it positions General Electric to capitalize on the growing trend towards hybrid energy systems, potentially enhancing its market share in the combined cycle segment while addressing sustainability concerns.

In September 2025, Siemens (DE) unveiled a new manufacturing facility in Southeast Asia aimed at increasing its production capacity for gas turbines. This facility is expected to streamline operations and reduce lead times, thereby enhancing Siemens' competitive edge in the region. The establishment of this facility reflects Siemens' commitment to meeting the rising demand for energy solutions in developing markets, which is crucial for its long-term growth strategy.

In July 2025, Mitsubishi Power (JP) launched a new digital platform designed to optimize the performance of combined cycle gas turbines through advanced analytics and AI. This initiative underscores Mitsubishi's focus on digital transformation, which is increasingly vital in enhancing operational efficiency and reducing downtime. By leveraging AI, Mitsubishi Power aims to provide its customers with predictive maintenance solutions, thereby improving reliability and performance.

As of October 2025, the competitive trends in the Combined Cycle Gas Turbine Market are heavily influenced by digitalization, sustainability, and the integration of artificial intelligence. Strategic alliances are becoming more prevalent, as companies recognize the need to collaborate in order to innovate and meet evolving market demands. Looking ahead, competitive differentiation is likely to shift from traditional price-based competition to a focus on technological innovation, reliability, and sustainable practices, as companies strive to meet the expectations of a more environmentally conscious market.