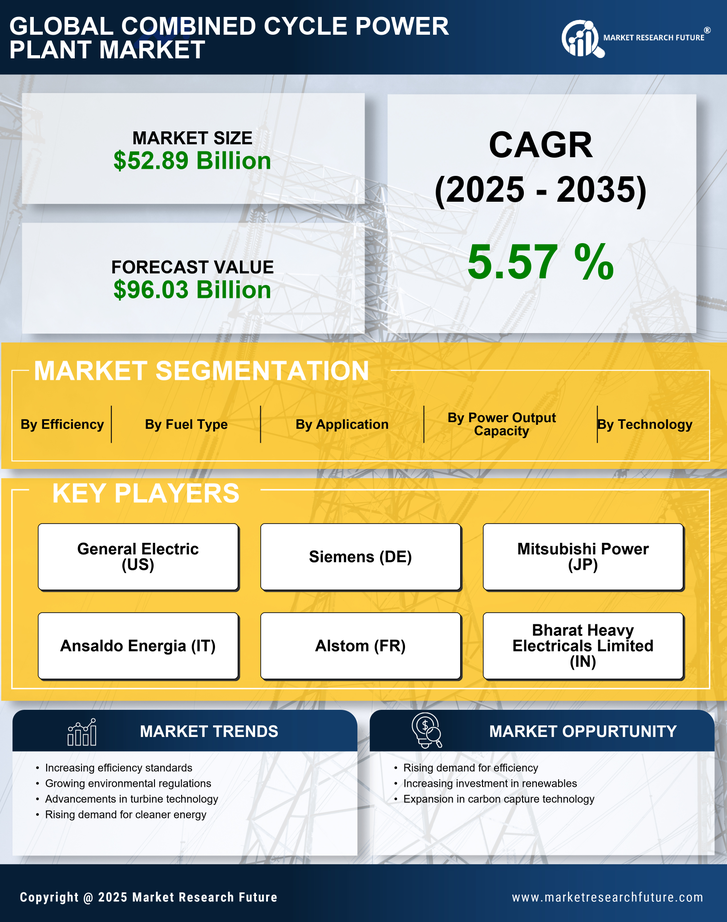

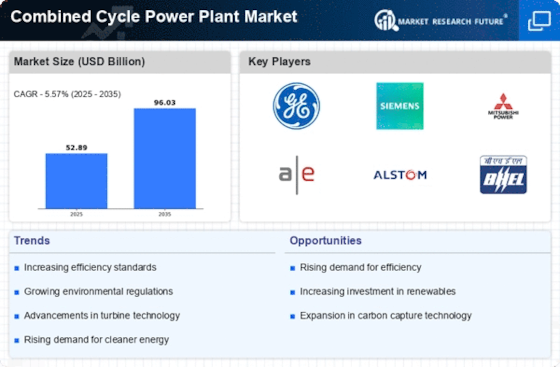

Rising Energy Demand

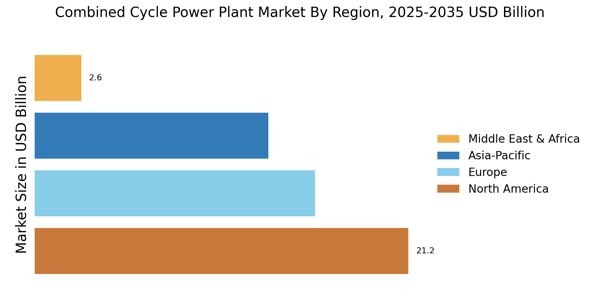

The increasing The Combined Cycle Power Plant Industry. As populations grow and economies expand, the need for reliable and efficient energy sources intensifies. According to recent data, energy consumption is projected to rise by approximately 30% by 2040. This surge necessitates the development of power plants that can meet this demand while minimizing environmental impact. Combined cycle power plants, known for their high efficiency and lower emissions compared to traditional plants, are well-positioned to address this challenge. The ability to generate more electricity from the same amount of fuel makes these plants an attractive option for energy producers. Consequently, the rising energy demand is likely to propel investments in the Combined Cycle Power Plant Market.

Shift Towards Natural Gas

The shift towards natural gas as a primary fuel source is a significant driver for the Combined Cycle Power Plant Market. Natural gas is increasingly viewed as a cleaner alternative to coal and oil, with lower carbon emissions and a smaller environmental footprint. This transition is supported by the availability of abundant natural gas reserves and advancements in extraction technologies, such as hydraulic fracturing. As countries seek to diversify their energy portfolios and reduce reliance on fossil fuels, the demand for combined cycle power plants, which utilize natural gas efficiently, is expected to rise. The International Energy Agency indicates that natural gas could account for nearly 40% of the global power generation mix by 2040, further underscoring the importance of the Combined Cycle Power Plant Market in meeting future energy needs.

Technological Innovations

Technological innovations are transforming the landscape of the Combined Cycle Power Plant Market. Advances in turbine technology, heat recovery systems, and digital monitoring tools are enhancing the efficiency and reliability of combined cycle plants. For example, the introduction of high-efficiency gas turbines has led to thermal efficiencies exceeding 60%, which is a notable improvement over previous generations. Additionally, the integration of artificial intelligence and machine learning in plant operations is optimizing performance and reducing operational costs. These innovations not only improve energy output but also contribute to lower emissions, aligning with global sustainability goals. As technology continues to evolve, it is anticipated that the Combined Cycle Power Plant Market will experience accelerated growth driven by these advancements.

Investment in Infrastructure

Investment in infrastructure is a critical driver for the Combined Cycle Power Plant Market. As nations strive to modernize their energy systems, substantial capital is being allocated to the construction and upgrading of power generation facilities. This investment is often aimed at enhancing grid reliability and integrating renewable energy sources. Combined cycle power plants, with their ability to provide flexible and reliable power, are becoming a focal point in these infrastructure projects. According to industry reports, investments in power generation infrastructure are expected to exceed several trillion dollars over the next decade. This influx of capital is likely to facilitate the development of new combined cycle plants and the retrofitting of existing facilities, thereby bolstering the overall growth of the Combined Cycle Power Plant Market.

Government Policies and Incentives

Government policies and incentives play a crucial role in shaping the Combined Cycle Power Plant Market. Many countries are implementing regulations aimed at reducing greenhouse gas emissions and promoting cleaner energy sources. For instance, various nations have established tax credits, grants, and subsidies for the development of combined cycle power plants. These initiatives encourage investment in cleaner technologies, making it financially viable for companies to transition from older, less efficient power generation methods. Furthermore, the implementation of stricter emissions standards is likely to drive the adoption of combined cycle technology, as it offers a solution to meet these regulatory requirements. As a result, supportive government policies are expected to significantly influence the growth trajectory of the Combined Cycle Power Plant Market.